Société Générale

-

CEA Investissement, the corporate arm of the French Alternative Energies and Atomic Energy Commission, has sold €104m of shares in Soitec, the French semiconductor company, through an auctioned block trade won by Société Générale.

-

Wordline, the French payments company, has returned to the equity-linked market to sell a new five-year €600m convertible bond at a negative yield.

-

South Korean investment bank Mirae Asset Daewoo Co raised a $600m bond this week, but had to navigate questions around the stability of its rating and credentials to get past the finish line.

-

While bankers in the Northern hemisphere plan well-deserved summer breaks, the Australian and New Zealand dollar markets are set to remain open for business, with some competitive pricing on offer.

-

Russian steel producer Novolipetsk Steel (NLMK) has raised a €600m syndicated loan, as experts say that the continued presence of Russians in the market during the crisis is down to the resilience they were forced to acquire after years of sanctions.

-

Mozambique LNG, Africa’s largest project financing investment to date, has secured roughly $15bn of funding from a range of international lenders and credit agencies in one of the few sparks of emerging market loan activity this year. The deal shows there is still appetite for “overlooked” and lower-rated emerging market credits, bankers say.

-

Fives, the French industrial equipment group, has signed a €200m loan backed by the state, as government-backed facilities continue to prove essential to tackling the economic fallout from the coronavirus pandemic.

-

UniCredit attracted plenty of demand for a €1.25bn sale of non-preferred senior debt in euros on Wednesday, as issuers took advantage of strong funding conditions ahead of the summer period.

-

Electricity Supply Board, the Irish utility, tapped its June 2030s on Wednesday, with the borrower one of a handful of credits taking advantage of sharply positive sentiment on the back of a potential coronavirus vaccine breakthrough.

-

South Korea’s NongHyup Bank (NH Bank) added to the flow of Covid-19 linked bonds from Asia on Monday. It raised $500m from a five year social bond.

-

US corporate bond issuers got straight back to business after the July 4 weekend as 11 borrowers raised $10.8bn, though the volume of issuance is tapering off as companies head into earnings blackouts.

-

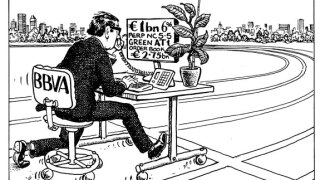

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.