Santander

-

◆ Spanish bank parent takes out £600m at seven year maturity ◆ Deal comes at a premium to euros but broadens its diversification drive across markets, issuing entities ◆ UK lender OSB Group improves on senior debut

-

Demand for its new 10 year trade finished above €137bn

-

Scarcity and 'clever tenors' deliver €7.2bn book for ABN as 'pragmaticism' secures €1bn for Santander

-

◆ European banks lead issuance with focus on senior funding ◆ Market wobbles prove funding more challenging than expected ◆ Foreign banks’ capital raising is one prominent feature

-

Bankers away from deal voiced concerns over level of orders

-

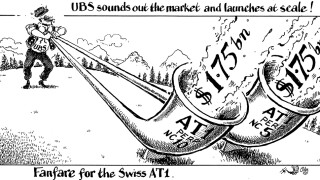

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

When the shockwave set off by the failure of Silicon Valley Bank swept the legs from under Credit Suisse, all the talent and relationships of a big investment bank were up for grabs. UBS has tried to hang on to what it sees as the best bits — but the biggest beneficiaries are likely to be rivals. Jon Hay and David Rothnie report

-

◆ Authority says banks sport best capital ratios ever thanks to improved profitability ◆ With net interest margins having or close to peak this may be about to turn ◆ Major banks unfazed by higher capital requirements as they boast strong buffers

-

◆ First euro AT1 for more than two months as Santander, other G-Sibs went for cheaper dollars ◆ Non-national champion status makes it 'not straightforward' execution ◆ Ongoing strong bid for yield

-

Issuance opportunities abound across capital stack but borrowers said to be happy to wait for deeper liquidity

-

The Spanish lender is looking to buck the trend among European banks that have tried and failed to build a sustainable presence in US investment banking

-

◆ Fourth deal in a little over a week will add to $6.5bn of AT1 issuance ◆ Comes just a day after Barclays garnered huge response for its tightly priced trade ◆ Santander seen focusing on achieving lower yield