Oceania

-

Australia and New Zealand Banking Group slipped in a successful euro benchmark covered bond on Thursday morning ahead of the European Central Bank’s rates decision. The borrower returned to euros for the first time in over a year and closed the tightest covered bond yet from an Australian issuer.

-

Münchener Hypothekenbank opened books on a £200m three year floating rate deal on Wednesday morning, becoming the latest borrower to take advantage of a starved sterling investor base.

-

Westpac has returned to the euro covered bond market for the first time since last July, mandating leads for another seven year. It follows trades from BNP Paribas and HSBC where demand was fuelled by central bank statements, that bankers said had exacerbated a short squeeze, causing investors to give up new issue premiums to get current coupon exposure.

-

The primary market picked up momentum on Thursday with three benchmark deals and one benchmark sized tap being syndicated. ANZ, Bankinter, KBC and Compagnie de Financement Foncier (CFF) unearthed a over €3bn of demand.

-

ANZ looks set to price the first sterling FRN since last May and its first ever covered bond in that currency. It has returned to the covered bond market for the first time this year to take advantage of swelling demand in sterling.

-

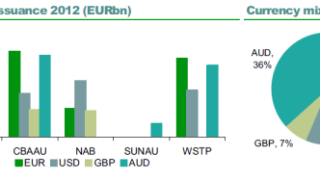

Commonwealth Bank of Australia has demonstrated how globalised the covered bond market has become by selling almost half of the year’s first dollar covered bond benchmark to European buyers. CBA issued its deal, Australia’s first covered bond of 2013, on Wednesday. The $2bn 0.75% January 2016 was priced at the tight end of guidance at 32bp over mid-swaps and 44bp over US Treasuries through joint leads Barclays, CBA and RBC Capital Markets.

-

Commonwealth Bank of Australia is ready to launch the first Australian covered bond of the year, after mandating banks for a benchmark US dollar deal that an official close to the deal told The Cover was likely to come on Wednesday. The Australian covered market is set to be the fastest growing this year, with Fitch predicting up to $37bn of supply.

-

Australia has been the covered bond growth engine this year, adding $44bn to its market. With no redemptions due in 2013, it is set to grow faster than any other covered bond market again next year, though not at quite the same pace, bank analysts predict.

-

Westpac has brought its second US dollar bond of 2012 — the fifth such deal from Australian banks this year. Following a US roadshow last week, it was heavily oversubscribed and priced on Tuesday at less than half the spread of its first US deal, launched in November 2011.

-

National Australia Bank has returned to the euro market with a covered bond that is twice as long as its previous euro financing but at less than half the cost. Despite that, initial guidance was cheap relative to its peers. Yet the swell of demand it has attracted should ensure the final print is tighter.

-

A sustained spread rally drew Suncorp Metway back to the covered bond market on Thursday. The borrower had originally scheduled a second Australian dollar benchmark for 2013, but found funding conditions too attractive to ignore.

-

After an impressive rally in covered bond spreads, Australian banks are likely to concentrate on offshore markets for covered issuance and use RMBS to tap the domestic buyer base, the Reserve Bank of Australia’s assistant governor for financial markets said on Monday.