Nordics

-

Standard & Poor's and Moody’s have delivered verdicts on Skandinaviska Enskilda Banken with rating actions.

-

Standard & Poor’s on Friday changed its outlook on DnB Nor from stable to negative on expectations that the Norwegian bank’s asset quality will deteriorate further.

-

Commerzbank will today (Friday) price the first unguaranteed senior unsecured bond from a German issuer since the collapse of Lehman Brothers.

-

Activity in the euro government guaranteed bank debt market has picked up since Monday’s Swedbank issue, but only moderately. And despite an improvement in market sentiment, covered bond banks are keeping investors waiting for a follow-up to last week’s jumbo from Crédit Agricole.

-

The government guaranteed bank debt market was the juncture of two waves of negative sentiment in the markets this week, as downgrades hit the sovereign market and financial institutions suffered renewed pressure.

-

As part of a second aid package for Danish banks, the Danish government has extended guarantees to junior covered bonds in a move aimed at protecting the outstanding covered bonds of Danish mortgage institutions.

-

Bayerische Landesbank and Danske Bank have priced their first government-backed senior unsecured issues on the back of larger order books and the next deals from Germany and Denmark are said to have been mandated for launch soon.

-

Danske Bank launched the first government-guaranteed deal for a Danish bank this (Wednesday) morning. Bayerische Landesbank opened books on a SoFFin-backed deal, while unguaranteed senior supply has reached new areas.

-

Euro denominated mortgage bonds issued by Danish covered bond institutions through a new Luxembourg-based central securities depositary have been approved as collateral for loans with the European Central Bank.

-

Danish covered bond issuers have completed the December auctions of their covered bonds. Dkr300bn (Eu40.3bn) of Danish krone bonds and Eu9bn of euro denominated bonds were sold to investors.

-

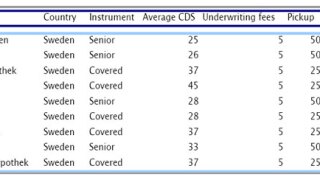

Swedish issuers have told The Cover that it is unlikely they will be making use of the government guarantees available to them for covered bonds. While the costs of such issuance may be interesting relative to guaranteed senior unsecured issuance, other considerations work against it.

-

The Finnish government will apply the same methodology as Sweden to determine the individual fees banks will have to pay to make use of the guarantee scheme for covered bonds.