News content

-

Following European bond issues by Volkswagen Financial Services, Volvo Car and RCI Banque last week, another car company entered the market on Monday. Toyota Finance Australia issued a two and five year bond that showed the market was very much open for business and full of demand.

-

Network International, the Dubai-based payments company listing in London, was covered throughout its price range on its first day of bookbuilding on Monday. It built on a surge of momentum after it announced US firm Mastercard as a cornerstone investor in its IPO in March.

-

SSE, the UK gas, electricity and telecoms company, has refinanced its £1.3bn revolving credit facility, joining the growing trend of companies linking the margins on their bank debt to sustainability indicators.

-

Banca Carige has sold one of its outstanding covered bonds back into the market as the ailing Italian lender comes into a crucial period for turning its business around and attracting buyout bids.

-

Turkey’s ruling party AK was victorious in Sunday’s local elections, although polling poorly in major cities — a result that investors think will hasten economic reform.

-

A senior director in the capital markets funding team at a German agency has left to join UniCredit’s FIG team in Munich, GlobalCapital understands.

-

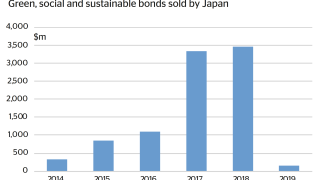

Japanese issuers’ supply of green bonds has rocketed in recent years. The country boasts a more diverse set of borrowers and a broader distribution of proceeds than many of its peers but further market development will present unique challenges, writes Morgan Davis

-

Participants in the financial institutions bond market were bewildered to see Coventry Building Society paying up to issue a new additional tier one and tender for an old one this week. But the transaction gave other issuers a window into how European rules on bank capital may be applied in practice — something that could pave the way for new and more liberal approaches to calling and refinancing AT1s, writes Tyler Davies.

-

Romania printed a €3bn triple trancher this week, the country’s largest ever euro deal, with one of the three tranches also being the longest ever euro bond from the country.

-

State oil company Saudi Aramco is expected to tap the bond market in the next fortnight for a deal that could be anywhere in the region of $7bn-$15bn, according to bankers in the region away from the deal. Estimates of the premium Aramco will have to pay over the Kingdom of Saudi Arabia curve is being discussed as negative to plus 15bp, depending on the size of the deal.

-

Dutch insurer Aegon surfaced in the euro market on Thursday to sell a restricted tier one deal that investors had been expecting for the best part of the past two years.

-

Issuance of Italian bank debt in 2019 has nearly caught up with last year’s running total. Banca Popolare di Sondrio this week followed Mediobanca and UniCredit into the market to cap off a big week of supply by the nation’s lenders. The run could yet extend further, with UBI Banca gearing up for a debut green bond.