Morgan Stanley

-

◆ Size was at upper end of recent range ◆ Book was over €30bn at one point ◆ Portuguese bonds still tight versus peers

-

◆ Supra begins 2025 with back-to-back deals ◆ Book was huge at over €47bn ◆ Recent secondary tightening helps execution

-

◆ First out of three Belgian euro syndications proved a hit ◆ Usual 2bp premium paid ◆ Italy to follow with potential €20bn deal

-

◆ Joint largest size from non-UK public sector issuer ◆ ADB also raised £1bn ◆ Cross currency basis allows for sterling concession

-

◆ Deal more than twice covered ◆ Pricing tightens 3bp ◆ KfW expected to open supply next week

-

◆ Tuesday tap surprise was pre-funding ◆ Next year’s programme revealed ◆ Historical spreads facing French agencies

-

◆ Tap was four times covered ◆ No premium required ◆ Spread to mid-swaps attracts

-

UK lender adds to Yankee invasion as domestic trio go super long

-

◆ Potentially final benchmark issuance of 2024 ◆ Pricing 'more or less in line' with fixed rate curve

-

◆ Deal thought to be KfW's dollar benchmark finale for year ◆ Tight Treasury pricing beats World Bank's 6.9bp record spread ◆ Issuer has no need for a big benchmark

-

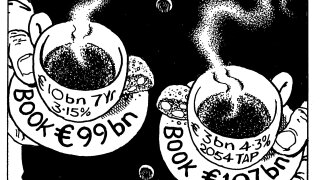

◆ Dual-tranche deal attracts €200bn of orders ◆ New seven year was somewhat unexpected ◆ Bookbuilding started with 4bp of premium

-

◆ US bank brings sizeable sterling deal ◆ Fair value debated ◆ Bankers say sterling starved of supply