Germany

-

Covered bond supply surged this week with investors piling into deals that offered little new issue concession and negative spreads, leading to concern that an inflection point was at hand. However, there was no sign of investor pushback, with the tightest deals from core European issuers experiencing a high level of demand. But some bankers were left wondering just how long the superb conditions would last.

-

The European Commission is taking steps to encourage future deals in the new asset class. It published the findings of a report on Wednesday and recommends standardising the regulatory framework.

-

National Bank of Canada (NBC) priced the first 144a three year dollar benchmark since July 2013 on Monday. The lack of comparable deals meant there was an element of discovery in pricing, which was almost excessively defensive. BayernLB was set to price a three year Reg S public sector dollar benchmark.

-

La Banque Postale printed its first soft bullet euro covered bond, paying a 0bp-1bp new issue premium for its market return, and Helaba doubled the size of its 1.875% 2023s to €1bn with a tap on Tuesday.

-

Deutsche Hypo returned to covered bonds for its annual benchmark on Monday, building a heavily oversubscribed book for its €500m seven year mortgage Pfandbrief in a record 10 minutes.

-

Two European banks announced covered bond mandates on Monday – La Banque Postale in euros and BayernLB in dollars.

-

National Bank of Canada is on track to sell a $750m three year covered bond, its first covered bond in dollars since 2011.

-

Berlin-Hannoversche Hypothekenbank (BHH) mandated leads to market the first green pfandbrief, or Grüner Pfandbrief, setting the stage for further green covered bonds and RMBS due this year and next. In contrast to last year’s environmental and social governance deal from Münchener Hypothekenbank, the forthcoming transaction will be of benchmark size and will be backed exclusively by energy efficient buildings.

-

The German issuer mandated joint leads for a seven year €500m no grow mortgage backed Pfandbrief on Friday for likely issuance on Monday.

-

Berlin Hypothekenbank has mandated joint leads for a European roadshow to market the first Green Pfandbrief.

-

HVB returned to the covered bond market for its first and only mortgage-backed covered bond benchmark of the year on Tuesday and enjoyed a solid reception. The choice of tenor, deal size and timing all played important roles in the deal’s success.

-

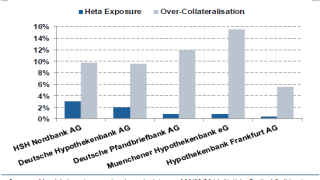

The decision to remove Heta exposure from Pfandbriefe collateral pools and add substitute assets has strengthened the position of investors and has demonstrated the importance that the German banking industry places on the reputation of the Pfandbrief product, said Moody’s on Monday.