German Sovereign

-

Germany’s Joint Laender hired five banks on Wednesday to run a 10 year deal, while the European Stability Mechanism received a riotous reception to a long five year at sub-Libor levels.

-

This week's scorecard covers the funding progress of sovereign issuers, with Belgium, Ireland, Netherlands and Portugal all over the halfway mark on their programmes for the year. Next week's scorecard will deal with European supranationals and agencies.

-

Land Nordrhein-Westfalen this week sold the first Brazilian real deal from a German sub-sovereign. The region, which notched up another new currency earlier this year when it debuted in New Zealand dollars, is keen to explore niche currency issuance to offer investors a pick-up in yield, according to MTN dealers.

-

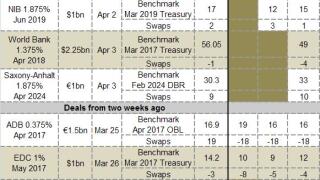

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Ireland's return to bond auctions last month helped the sovereign reach nearly 60% of its funding target for the year. Across the Irish sea, the UK started its financial year with a £2.577bn auction - and a reduced funding target of £128.4bn.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

German pension funds have joined Japanese investors hunting for long dated paper from sub-sovereigns, according to medium term note dealers. German regions are beginning to tap the demand and push further out the curve — State of Brandenburg is set to print a seven to 12 year note this month.

-

Norway’s Kommunalbanken is set to print its first euro benchmark bond this week, after mandating a group of banks on Monday for a €1bn no-grow five year deal.

-

Strong Asian demand helped the North Rhine-Westphalia increase the size of its first benchmark of the year on Wednesday, despite the issuer pricing the bond at the tight end of guidance.

-

This week's scorecard focuses on the funding programmes of selected German states and agencies. Next week's scorecard will feature French agencies.

-

A remarkable start to the year for the eurozone periphery is in clear view in this month's sovereign funding scorecard. Just two months into the year, Portugal has completed more than half of its target, while Ireland is not far behind. At the other end of the volume spectrum, Spain is making good headway in tackling its €133.3bn target with 26% completed, while Italy — which has yet to sell a syndication this year — is behind on 18%.

-

Several cities in Land Nordrhein-Westfalen banded together to sell one of the first joint deals from German cities on Thursday. The deal appealed to domestic and international investors and could inspire other cities in the country to access the public debt markets.