Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

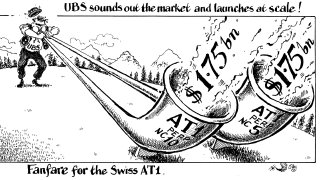

◆ Fourth deal in a little over a week will add to $6.5bn of AT1 issuance ◆ Comes just a day after Barclays garnered huge response for its tightly priced trade ◆ Santander seen focusing on achieving lower yield

-

◆ Strong market sentiment backs new deal and potential FIG issuance as spreads tighten ◆ Views on NIP differ but SG's outcome was unanimously 'very good' ◆ Austrian and Australian issuers on the way

-

◆ Issuer takes advantage of red-hot sentiment post-CPI ◆ Higher yielding bank capital prices moved up, including a similar AT1 from Barclays ◆ Strong demand suggests tight pricing eyed

-

◆ Deal comes amid pronounced bid for yield ◆ Pricing new deal inside 12% seen as 'good result' ◆ Issuer combines tender of old bond five months ahead of early redemption

-

◆ Portuguese lender has authorisation to redeem its only AT1 early ◆ Atypical action suggests no replacement deal ◆ Last week's red-hot AT1 reception suggests strong demand reserved for biggest banks

-

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears