Euro

-

Issuer offers to exchange hybrid rather than not call it, but some say it's just kicking the can down the road

-

US firm launches €750m trade and opens books on five dollar tranches to refi Adenza acquisition

-

◆ Successful growth of deposit base funds tender ◆ P&L uptick ◆ PBB has not issued public debt since January

-

Credit investors look to lock in top quality names even at tight spreads

-

After Tuesday's difficulties, the Dutch bank showed the market works

-

◆ Deal gives hope for more Greek senior issuance ◆ IG ratings appear mostly to have been priced in ◆ Alpha prices tighter than Slovenia's NLB

-

Issuer's paper is trading tightly despite the new loan pushing expected demerger talks further away

-

Tightest deal from LBBW struggled to reach full subscription as investors leaned towards spread

-

◆ Alpha to restart what is expected to be more Greek supply ◆ One debut green euro bond prices, one more to come ◆ Demand for short end paper swiftly absorbs reverse Yankee

-

◆ Several factors behind the aggressive pricing technique ◆ Scarcity value pays off in 'super strong' market ◆ Possible refinancing of a called, grandfathered tier two

-

Pipeline includes LBBW's dual tranche that will also feature a 10 year maturity

-

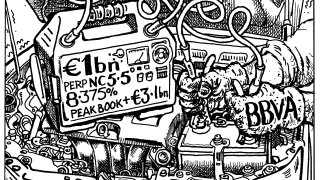

Demand for high yielding paper drives comeback for most subordinated bank capital