Credit Suisse

-

Patrick Porritt has left Credit Suisse, as the bank promotes new faces.

-

Credit Suisse is set to move a financial institutions debt syndicate banker from his role in Europe to a position the US in the second quarter of 2020.

-

Green deals from Hypo Vorarlberg and Russian Railways were sold in Swiss francs this week in what were immensely tricky conditions. The market was awash with deals in January and February, but many feel the spread of coronavirus will bring a halt to the momentum moving into March.

-

India’s market regulator has given Equitas Small Finance Bank (ESF) the go-ahead for its IPO, which is expected to raise about Rp10bn ($136.3m).

-

United Hampshire US Real Estate Investment Trust (Reit) has wrapped up the international roadshow for its $323.6m Singapore IPO, boosted by investors' search for stability amid volatile markets.

-

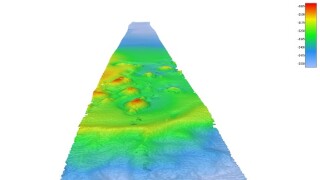

The only high yield bond deal being actively marketed in euros this week has been postponed. The deal was for Fugro, the Dutch company that provides geographical data and asset integrity services to onshore and offshore industries. It was a debut issue for a listed company with no sponsor involved, so there had been good interest, but market conditions just proved too difficult.

-

Syngenta, the Swiss agrichemicals company, on Tuesday sold its first Swiss franc bond since being acquired by China National Chemical Corp (ChemChina) in 2017. But other mandated deals hang in the balance as the Covid-19 coronavirus spreads across Europe.

-

United Hampshire US Real Estate Investment Trust has launched Singapore’s second Reit listing of the year. The deal comes as volatility around the world has brought many IPO markets to a halt, with investors looking for safe-haven opportunities. Jonathan Breen reports.

-

Credit Suisse has hired a head of environmental, social and governance equity research for Asia Pacific, a newly created position at the bank.

-

Conditions are changing so fast with the coronavirus epidemic that each day could bring a change in sentiment, but for the time being leveraged finance is staying calm and continuing to function. There is more activity in this high risk corner of Europe’s capital markets than in any other, apart from sovereign, supranational and agency bonds.

-

United Hampshire US Real Estate Investment Trust (Reit) has kicked off the roadshow for a $323.6m Singapore IPO on the back of chunky cornerstone investor orders, according to a source familiar with the matter.

-

Four Chinese property companies raised $2bn between them from dollar bonds on Monday, coming at a particularly turbulent day for markets globally as fears rise around the rapid spread of Covid-19 outside of the Mainland.