Credit Suisse

-

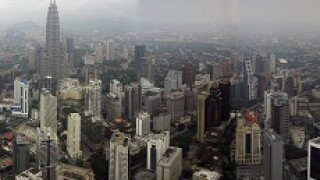

Credit Suisse has hired a senior banker from Maybank to head up its Malaysian investment banking coverage, sources said.

-

China’s Cifi Holdings is taking orders for a perpetual non call five year bond on Tuesday, returning to the public dollar debt market after more than two years.

-

Nasdaq-listed YY launched a share sale on Monday that could raise around $463m based on its latest price.

-

Chinese biopharmaceutical company Zai Lab has appointed a pair of firms to lead its US listing, as a host of other Mainland companies also prepare to float across the Pacific.

-

21Vianet Group, China Huiyuan Juice Group and Greenland Holding Group managed to steer their dollar outings in the right direction on Thursday, defying any concerns among investors to get their deals past the finish line.

-

Indonesia’s Medco Energi Internasional braved a rocky market to grab $300m on Thursday, deciding to go ahead with its issuance on expectations of worse conditions further ahead.

-

The US investment grade corporate bond enjoyed a huge week of issuance as nine borrowers printed deals on Monday before British American Tobacco delivered $17.25bn on its own on Tuesday and plenty more came on Wednesday and Thursday. Bankers predict another heavy week to follow before supply slows for the traditional summer break.

-

Peruvian power generator Cerro del Aguila attracted more than $3bn of orders for its inaugural Eurobond on Wednesday.

-

Indonesia’s Medco Energi Internasional, which counts state-owned electricity generator Perusahaan Listrik Negara as one of its clients, is marketing a new dollar bond.

-

Three Chinese high yield credits opened books for fresh dollar deals on Thursday, wooing investors in the quiet summer market. Greenland Holding Group Company is making a return, while China Huiyuan Juice Group and 21Vianet Group are ready for their debuts.

-

US payments processor Vantiv has signed a $1.6bn term loan with a trio of banks for its £9.3bn merger with UK peer Worldpay.

-

Conditional books are already oversubscribed for the €240m term loan that funds the Ontario Teachers' Pension Plan's acquisition of Mémora, an Iberian funeral services provider.