Colombia

-

Bankers expect another quiet week or two unless sovereigns dip into the market

-

Investors hope a new government can sort out country's fiscal mess

-

Investors welcome country's efforts to reduce bulging debt burden, but there is nagging worry

-

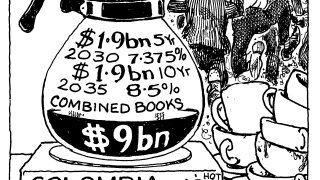

The sovereign has had a busy year of issuance and liability management

-

The country is taking an exchange rate risk, but perhaps not a big one

-

The food maker made its bond market debut in May

-

Sovereign is working to diversify its funding sources, including with an unprecedented loan

-

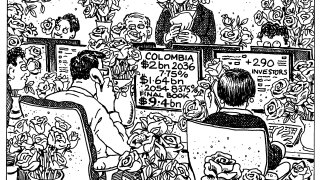

Investors hope a government more open to fiscal tightening will come to power in 2026

-

Sovereign pays at least 25bp of concession but points to healthy demand after broader spread widening

-

LM in vogue despite higher coupons as Ambipar tenders its debut bond issued a year ago

-

Investors are "cautious" on LatAm credit, said one fund manager

-

Execution impresses as sovereign found itself in sub-par market conditions