Asia Pacific

-

Property developer and manager Kaisa Group Holdings has raised HK$2.59bn ($332.97m) from shareholders of its Hong Kong listed stock, to be partly used to fund an acquisition.

-

Three regular dollar bond issuers from China were the first out of the gates to tap investors on Thursday following a long holiday in the Mainland.

-

In this round-up, China’s trade surplus jumps in the first four months of the year, regulators unveil details for implementing the cross-border Wealth Management Connect pilot scheme between the Mainland, Hong Kong and Macau, and Beijing decides to suspend all activity under the China-Australia Strategic Economic Dialogue.

-

Golden Energy and Resources drew in investors with an 8.875% yield on its bond on Thursday, allowing the mining company to raise $285m.

-

KB Kookmin Card raised $300m from its debut in the offshore dollar bond market this week, using a sustainability-labelled deal to add further momentum to the asset class.

-

BOC Aviation has raised $250m from a tap of bonds sold just last month, finding solid support from US investors for its comeback.

-

China Nonferrous Mining Corp has raised HK$990m ($127.5m) from the sale of a chunk of shares, offloaded following a surge in its stock price.

-

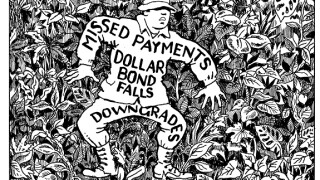

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

The Philippines’ equity capital markets got another boost this week as Monde Nissin Corp was swamped by investors placing pre-launch bids for its upcoming billion-dollar IPO, set to be the country’s largest ever listing. The market is shaping up to be one of the busiest in southeast Asia this year, tapping into growth in the consumer sector. Jonathan Breen reports.

-

Credit Suisse has made a number of appointments to expand its private wealth business in Asia.

-

Philippine property developer SM Prime Holding has returned to the loan market after an absence of five years.

-

I was talking to a few loans bankers this week and was surprised when they revealed privately that they had very little interest in social loans. That gave me an idea.