Asean

-

A $300m dual-tranche borrowing for a subsidiary of palm oil producer Golden-Agri Resources has launched into syndication. The money was funded by four banks in mid-2015.

-

Deutsche Bank has appointed Jake Gearhart as head of debt syndicate and origination for Asia Pacific.

-

India’s stock market regulator has published consultation papers on real estate and infrastructure investment trusts while Singapore’s financial regulatory authority has firmed up its rules for real estate investment trusts (Reits).

-

While all eyes are on China and turmoil in the mainland equity markets, our columnist turns his gaze to Indonesia where once again the government is attempting to privatise state-owned companies.

-

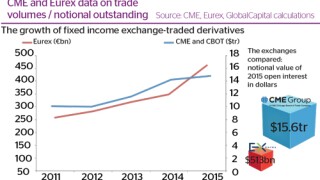

Competition between derivatives exchanges is intensifying, giving rise to a rash of product and platform launches in 2015, as well as geographical expansion. But 2016 will be dominated by regulatory deadlines for electronic trading. As Dan Alderson reports, exchanges that best prepare market participants to meet these requirements will be the ones that will win out.

-

Malaysian low cost carrier AirAsia is set to make its first outing to the international bond market having mandated three banks to arrange a series of fixed income meetings.

-

A $600m loan for the upstream oil and gas arm of Perusahaan Gas Negara (PGN) has seen commitments worth $100m come in so far.

-

Hong Kong-listed China SCE Property has completed a $400m fundraising via four mandated lead arrangers and bookrunners.

-

Manulife US Real Estate Investment Trust (Reit) is reviving its plans to list in Singapore after shelving an IPO in 2015, and is aiming to launch in the first half of this year, according to a source close to the deal.

-

India’s stock market regulator has published a consultation paper on real estate investment trusts (Reits) while Singapore’s financial regulatory authority has firmed up rules governing the asset class.

-

Struggling Indonesian company Trikomsel Oke has had its debt payment obligations suspended, according to an official statement released by the firm on January 4.

-

Lippo Malls Indonesia Retail (LMIR) Trust has wrapped up a S$100m ($70.6m) term loan with three lenders.