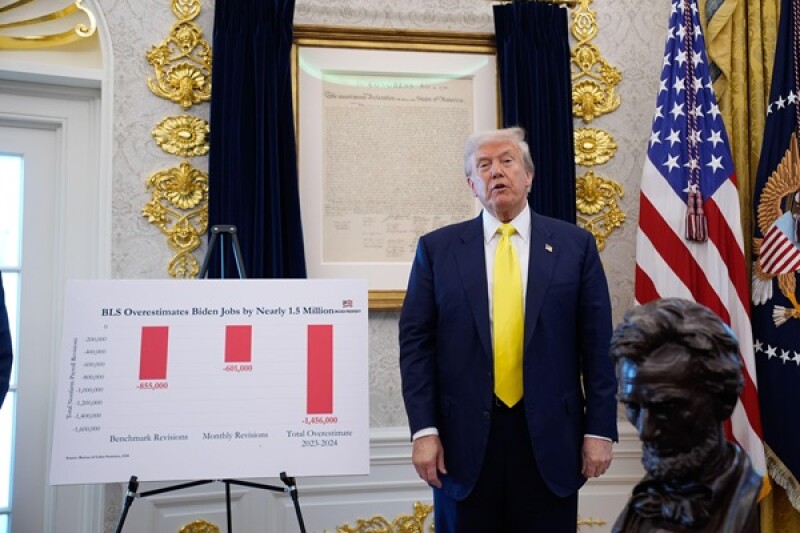

US president Donald Trump’s decision to replace Bureau of Labor Statistics (BLS) commissioner Erika McEntarfer with the Heritage Foundation’s E. J. Antoni is a serious threat to capital market stability.

Trump fired lifelong government economist McEntarfer on August 1, after revisions in the July BLS jobs report showed the US economy had created just 35k jobs a month in the previous three months.

Last Monday, the White House announced the nomination of E.J. Antoni, the 37 year old chief economist of the Heritage Foundation, as her replacement.

Even more concerning than Antoni’s undeniable lack of experience is his well-documented fealty to Trump.

The economist stood alongside the president’s supporters in Washington D.C. on January 6, 2020, though it is not believed he took part in the attack on the Capitol building.

The White House claims Antoni was “a bystander” at the insurrection. But on Monday, Wired revealed a now deleted X account bearing Antoni’s name had backed various conspiracy theories, including Trump’s claims that the 2020 election was rigged.

Trump’s threats to Federal Reserve chair Jerome Powell have garnered more attention than his BLS decision. But the politicisation of government data poses as much, if not an even greater threat to capital market functioning than the executive branch's control over the Fed.

Days before his nomination, Antoni claimed the BLS should pause the publication of its monthly jobs data. A few week later, his colleague Stephen Moore claimed Antoni had changed his mind and would publish the numbers once installed.

Yet considering his background, there is little doubt the new BLS commissioner would go along with Trump’s wishes if the president were to demand a pause, or even modification, in official data releases.

JP Morgan chief economist Michael Feroli rightly pointed out in a note earlier this month that the Treasury Inflation-Protected Securities (TIPS) market, which incorporates the BLS’s Consumer Price Index (CPI) releases, would be particularly vulnerable to data manipulation.

But the impact of losing trust in US economic data could be felt much further afield.

The global economy’s fate is still heavily dependent on the health of its largest source of demand, and as a consequence US data is the single most important input into countless investment decisions globally.

Contemporary capital markets are built on predictability and trust in economic data. If the US becomes a black box due to uncertainty over the accuracy of its public economic data, global capital markets will lose their bearings.

Putting in question this well-established predictability is also the greatest risk from Trump’s attack on central bank independence.

The true value of central bank independence for markets lies in the guarantee of low long-term inflation.

Inflationary pressures are rapidly bludgeoned through rate hikes, which protects asset values and returns. Governments with other ideas are kept at bay.

For over four decades, investors have allocated funds confidently thanks to this promise of stability — and a steady stream of reliable data.

In taking over first the BLS, and perhaps the Fed next, Trump is putting the entire edifice at risk.