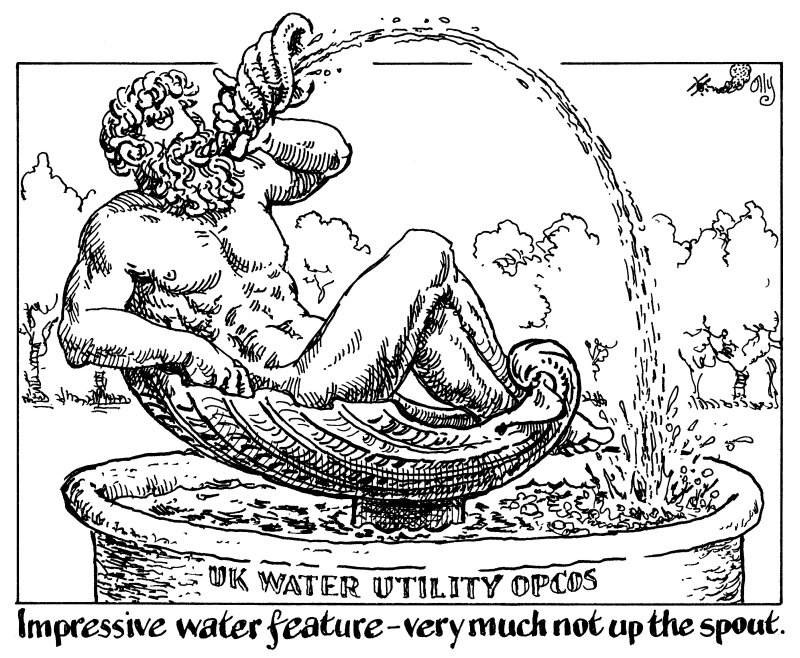

The bond market has been hearing since the summer that UK water companies are going down the pan, taking their debts with them. The reality, like the torrent of untreated waste being dumped into the UK’s coastal waters, is proving to be much murkier.

It started with Thames Water’s chief executive unexpectedly quitting in June. Then came talk of potential renationalisation, shareholder cash injections and subordinated bond prices collapsing.

Southern Water was another in the firing line. Fitch cut its ratings a notch in July on worries that it would run out of leverage headroom.

Less than six months later, investors this week threw so much money at Southern Water’s first bond issue since 2021 that the company bumped up the size during bookbuilding from ‘benchmark’ — which can be as low as £250m in sterling — to £400m, before printing £450m.

The company started with an eye-catching spread of 300bp over Gilts. But Southern Water is hardly an outlier in this regard — issuers of all stripes are paying yields, and in some cases spreads, almost unthinkable a few years ago.

GlobalCapital has long argued that the UK’s water companies would find a way. The operating companies, and their investors, are protected by what some market commentators have complained is a byzantine capital structure, but is really just a whole business securitization that gives them security over the assets and operating business.

It is no coincidence that Southern Water’s blowout bond was a Class A secured transaction.

Investors owning more junior holding company bonds might get hosed, but that is why they have earned extra yield. Water holdco investors should have a chat with real estate hybrid bond holders to get some front line advice on why buying down the capital structure does not really mean ‘senior with a bit of extra yield’, as is a bafflingly common belief.

Meanwhile, the market taps will be open for the water industry's operating companies for a long time yet.