An unexpected end of year rally for high grade corporate credit is the kind of idiosyncratic rarity that years of central bank market intervention stopped from happening. Those times are over, and weird, unexpected and borderline indecipherable events are going to become much more commonplace.

Corporate credit is on a tear. The iTraxx Europe Main index started Thursday at 68bp — 15bp tighter than where it started the month. The Crossover index tells a similar story, opening 73bp inside November 1’s close at 376bp.

This has been great for corporate bond issuance, with more deal flow in the past seven business days than in all of October.

But it has caused consternation too. Other than some rough guesses about the pent-up demand that a barren October created, or an improving rates outlook, it is hard to pinpoint an exact reason for the rally.

And if the market can’t decide a reason, the fear is that the market also won’t be able to see its abrupt end coming, either.

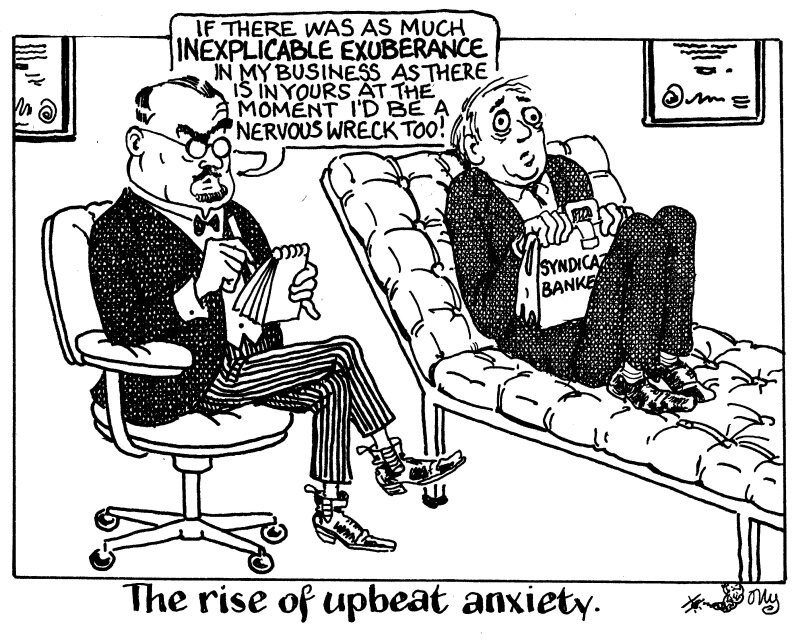

This is a difficult environment in which to print debt. Issuers must be good to go at a moment’s notice to take advantage, and, if their syndicate banks are responsible, they will explain to their clients that this window is built on amorphous foundations. Therefore, the deal that comes just as the rally crumbles could be theirs.

Unfortunately for those that like a bit of stability and rhythm to their issuance — namely, everyone — the past few weeks are probably a microcosm of what 2024 will bring.

The market is still settling after years of central bank bond buying, and the drift back to normality has not been linear, or smooth. There will be periods of difficulty when issuing bonds feels like the last thing that can happen and there will be periods of exuberance that bring with them their own sense of unease.

Get used to it.