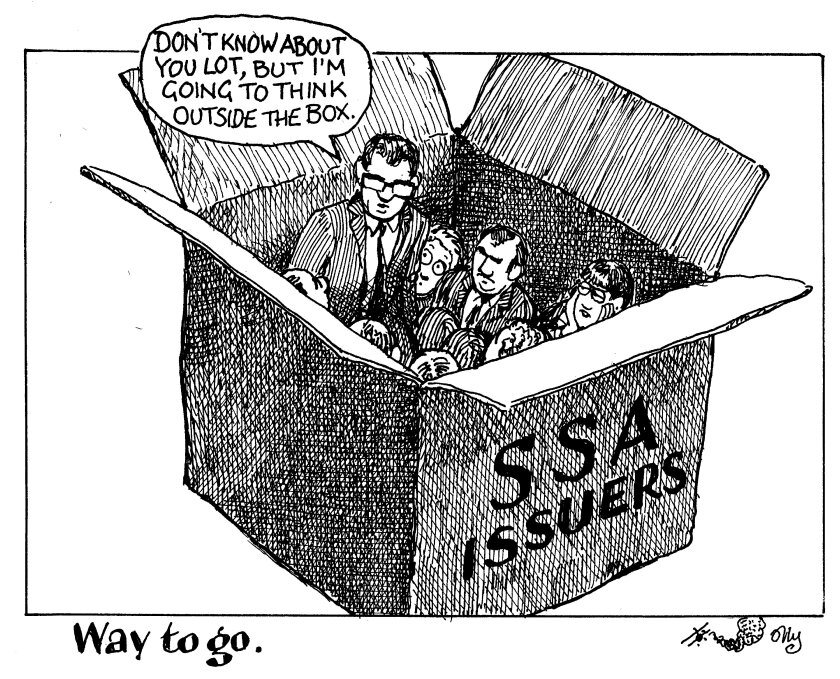

The saying goes that ‘slow and steady wins the race’ and those qualities are two that SSA issuers on the whole prize as chief characteristics. But for some looking to wrap up their annual funding in tricky markets, nimbleness, flexibility and sometimes creativity are bringing rewards.

Austria is one example. It executed a triple-tranche deal last week, a rarity for most SSA issuers, let alone a European government.

The move surprised some market participants, yet it made perfect sense, allowing the sovereign to take €6bn from two taps and a new issue by targeting different groups of investors than if it had just brought a single bond.

KfW recently sold its first ever dual-tranche syndication in US dollars. It was a choice the issuer thought “made sense” as it looked for volume. The $6bn it priced was the largest slug of dollar funding it has done in one go since 2016, according to Dealogic.

Neither trade fits SSA market conventions, where predictability and simplicity are prized. But the market called for it – and sensible issuers are adapting.

At a time of such uncertainty in the rates market, the smartest SSA issuers are the ones that make themselves all things to all people.