The European Union has finally agreed the text of its Green Bond Standard, a voluntary label that issuers can secure for their green bonds, if they meet strict criteria.

Market participants believe it could become a gold standard for the green bond market, setting apart deals whose assets nearly all comply with the EU’s Taxonomy of Sustainable Economic Activities and have sound verification and reporting.

This could be beneficial to the green bond market by setting a high bar issuers can aspire to, which may be rewarded by tighter pricing.

Supporters are delighted that this will help to combat greenwashing, and say it could lead to a more generous greenium for the best issuers.

But the Green Bond Standard can only help at the margins with the ultimate goal of sustainable finance: saving humanity from climate change and other environmental destruction.

The Standard will have the same limitation as the green bond market itself: it has no effect on issuers that do not issue green bonds. Even for those that do, it governs only the portion of the issuer’s activities that can be allocated against green debt, not the rest.

What the capital market really needs is for bond investors to start caring about the environmental impact of every bond, whether labelled green or not.

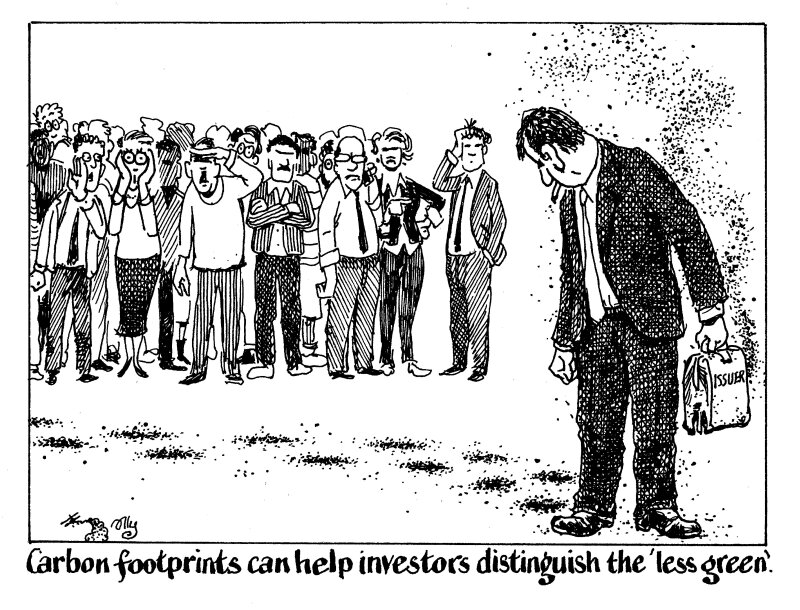

Standards of greenness that could be applied across the whole capital markets might genuinely give investors information with which to distinguish in a more profoundly useful way between green and less green companies — and governments.

Of course, the EU’s Taxonomy of Sustainable Economic Activities is designed to accomplish this, through the rather clumsy metric of dividing all activities into sustainable and not sustainable, and making issuers declare what percentage they do on each side. This is now in force.

A more powerful tool would be mandatory carbon footprints for all issuers, covering Scopes 1, 2 and 3 emissions to give a full picture of their climate impact.

Better still is pairing that with transition plans showing how the organisation plans to reduce its emissions, and by when.

Much of this information is available already for investors that look. The trouble is that most of them don’t.

A real leap forward for capital markets would be to include basic ESG metrics on deal term sheets, every time they are sent out to announce a bond issue. These should include ESG ratings, Taxonomy alignment, carbon footprint, and a summary of the issuer’s main transition targets and internet link to its detailed plans.

The Green Bond Standard has taken about six years since it was first proposed by advisers to the EU.

Adding a few basic environmental vital statistics to term sheets would take no time at all. With each issuer’s agreement, bookrunners could start doing it tomorrow.

There would be no need for compulsion — it would soon become a clear marker of which issuers were serious about climate change.

Investors would then no longer have any excuse for saying they had no way to distinguish between issuers. That would be a greenium worth having.