Capital markets participants are feeling rather better about themselves than a few weeks ago. Some promising signs in the battle against inflation are providing light at the end of the tunnel, and on Wednesday Fed chair Jerome Powell got investors excited by saying that rate increases could begin to get smaller as of this month.

Doing deals has become easier in several battered markets — including leveraged finance and equity capital markets. In EM, even Colombia — which had been looking at issuing ever since January but kept finding excuses not to — finally made its 2022 bow on Monday.

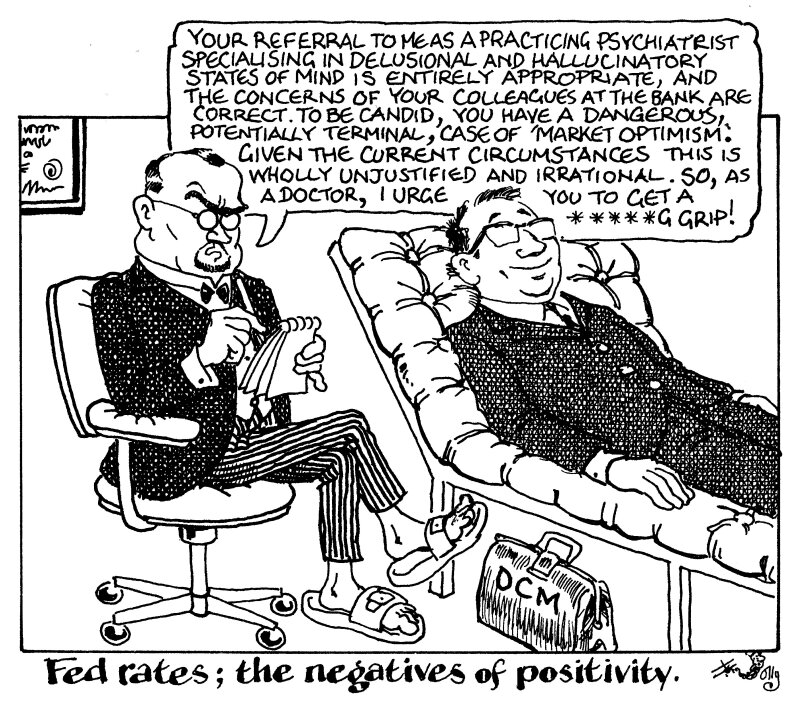

Much of this optimism is based around the apparent market consensus that the Fed Funds rate will peak at around 5%. Talking to DCM bankers about their hopes and fears for 2023, there’s a broadly-held view that the Fed will hit its terminal rate in the first quarter, investors can start getting excited about a pivot in monetary policy, and we’ll be able to look forward to far easier issuance conditions from the second quarter onwards.

But bond markets should not count on this. First of all, 5% would still not be a particularly high terminal rate compared to the previous occasions inflation was as high as it is today. As Jim Reid, head of global fundamental credit strategy at Deutsche Bank, pointed out this week, markets are pricing in a less aggressive cycle than 1973 — which proved to be nowhere near sufficient to control inflation and led to two far more aggressive cycles in 1976 and 1980.

Moreover, there continue to be several unpredictable potential pitfalls: the Russia-Ukraine conflict, China’s continuing Covid-zero policy, and a winter with high energy prices, just to name a few.

This time last year, very few, if any, forecasters saw the magnitude of 2022’s inflation and rate increases coming, so why are markets smiling so serenely based on today’s forecasts?

Many bankers spell out their thinking explicitly: “2023 will be better because it can hardly be worse than 2022”.

This might be true — especially for certain corners of the bond market such EM, where the fall in volumes has been precipitous (the slowest year since 2008 in the case of Latin America).

But it is hard to avoid the feeling that many in the market are being sucked into a complacent groupthink because they do not want to contemplate the possibility that there could be more demons in the macroeconomic closet.

You can’t blame market participants for being tired of doom and gloom, but they must be careful basing their optimism on wishful thinking.

For bond issuers, this is of particular importance: they cannot assume that better times are around the corner. Even if the reasons to be cheerful are valid and prove to be correct, 2023 will still be a year in which pragmatism should reign, funding should be done as early as possible, and no one should get too clever trying to time the market.