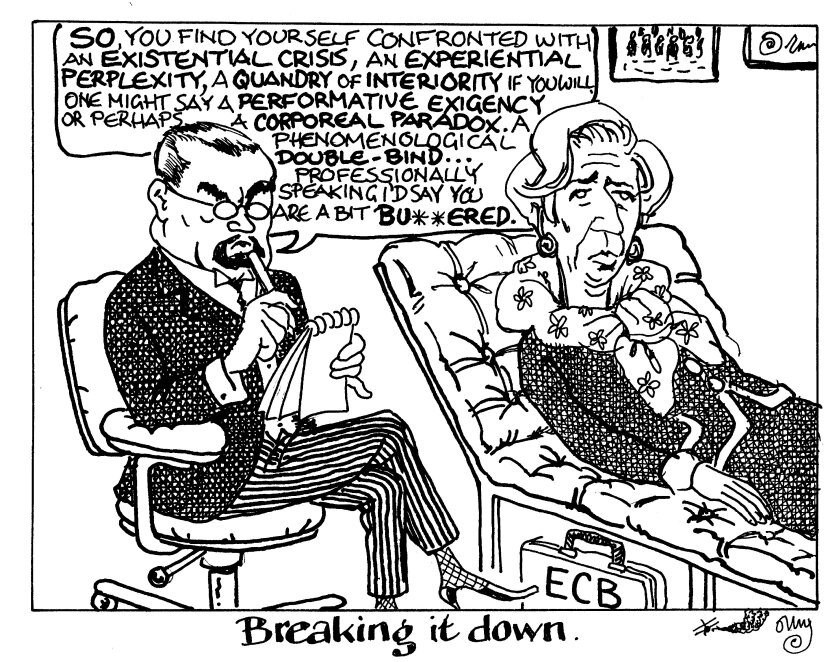

The European Central Bank is facing an existential crisis, as its core job of inflation gatekeeper pulls in the opposite direction to its assumed role as saviour of the eurozone.

The ECB held an unscheduled meeting this week to try to decide what is more important: getting record euro-era inflation down, as per its prime directive; or defending eurozone sovereign yields, as per the job it has taken on with increasing intricacy since the global financial crisis.

These two tasks are mutually exclusive. Fighting inflation means tightening policy, including by raising rates to encourage people to spend less. Protecting the eurozone, on the other hand, means more largesse, and firing up the money printers again to stop things such as Italian yields rocketing compared with German equivalents — as was seen last week when investors were left unimpressed by the ECB’s scheduled meeting.

After this week’s ad hoc meeting, it looks like the ECB is doing what it did best during the sovereign debt crises of the past decade: it is bodging it.

For months, the market has heard ECB president Christine Lagarde commit to the importance of sequencing, where net asset purchases from bond buying programmes must stop before rate rises can begin. This week, the market was told that, actually, the ECB is looking at putting together another type of bond buying programme to run concurrently with rate rises.

It’s another sticking plaster slapped on the leaky boat that is the eurozone economy. In fairness to Lagarde’s ECB, the US Federal Reserve and Bank of England are facing the same problem and are not doing much better.

The big problem is that the ECB needs to achieve both of its goals: lower inflation and saving the eurozone. Should either fail, the ECB’s credibility will be shot to pieces.