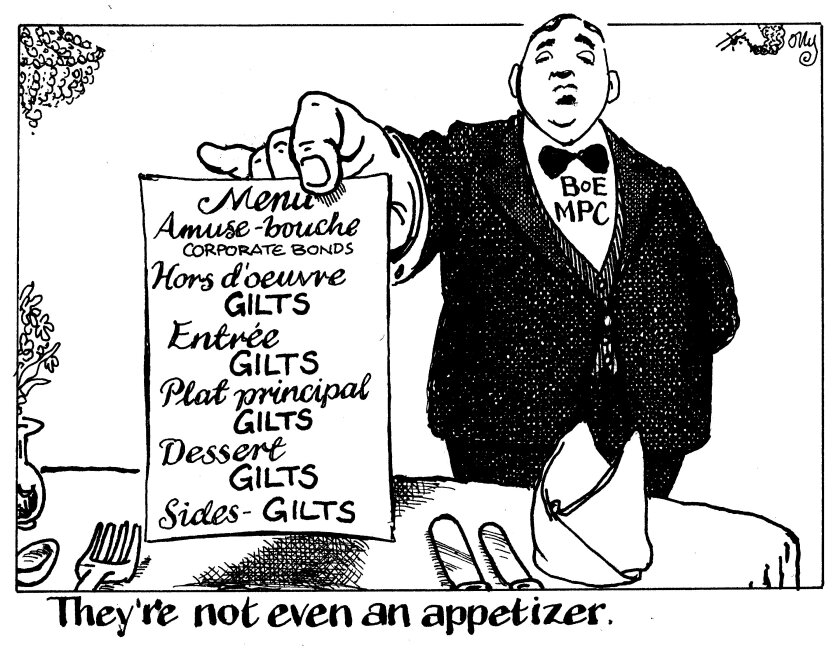

Painful as it may feel to UK corporate bond issuers and investors, from the lofty vantage point of the Bank of England their market is a mere speck on the landscape.

Everyone in the sterling corporate bond market was taken by surprise on February 3 when the Bank’s Monetary Policy Committee announced casually, amid other moves to get inflation under control, that it would sell the £20bn of corporate bonds it owns as a result of quantitative easing, rather than just ceasing to reinvest redemption payments.

The market flinched wider by 15bp-20bp and several firms have complained to the Bank about its communication, according to market sources.

The Bank was not particularly explicit about why it had chosen this path — but that merely underlined how insignificant this corner of the capital market seemed in the grand scheme of things. Since then, all the talk in sterling corporate bond circles has been about how the Bank will do the selling and what the effects could be, as GlobalCapital reported this week.

But market participants should reflect that perhaps the Bank has a point. Even for users of corporate bonds, the Bank selling its portfolio will not be the main event.

The Old Lady has £20bn of corporate bonds in her handbag — but £875bn of Gilts. That is not only a far greater absolute sum, but a much bigger share of the market, which totals £2.1tr.

The Bank has said it will stop reinvesting cashflows from these, starting with the £28bn it owns of the Gilt maturing in March. The Bank’s balance sheet will therefore shrink in big, uneven steps, and at an accelerating pace over the next three years.

The corporate bond jumble sale will undoubtedly require watching, and may unsettle the market. But it will remain a sideshow. The real driver of all-in yields will be what the Bank does with Gilts.

For the time being, its stance is to hold back from reinvesting principal. But the MPC has said it will “consider” — a word repeated with emphasis by one Gilt specialist this week — selling its Gilt holdings actively, once interest rates have topped 1%.

Compared with calving those icebergs into the sterling sea, selling a few corporate bonds will be like skimming pebbles across a pond.