A few years ago, sustainable finance experts had got used to a feeling of frustration and disappointment. Their market was growing, but not fast enough for it to fulfil their hope: that it could help to finance the transformation of the economy.

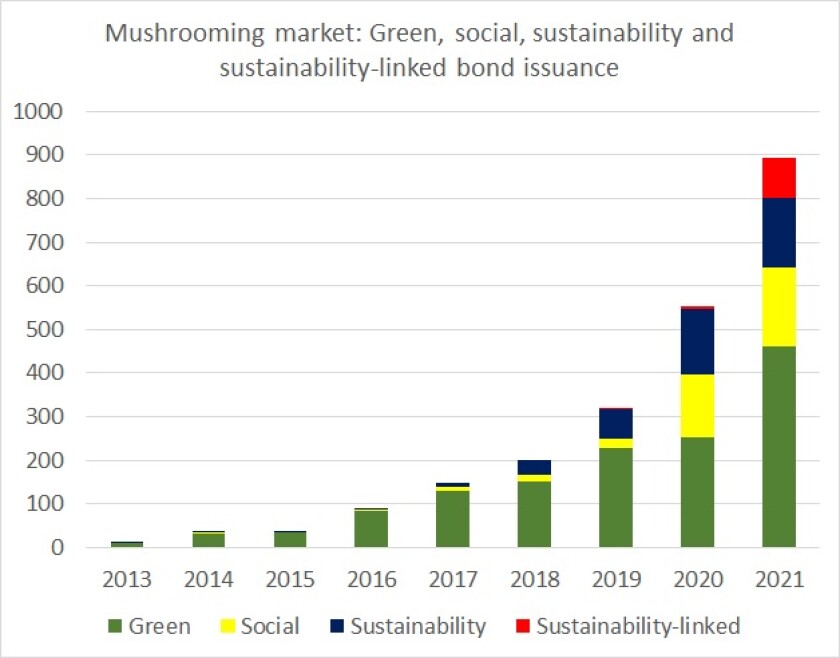

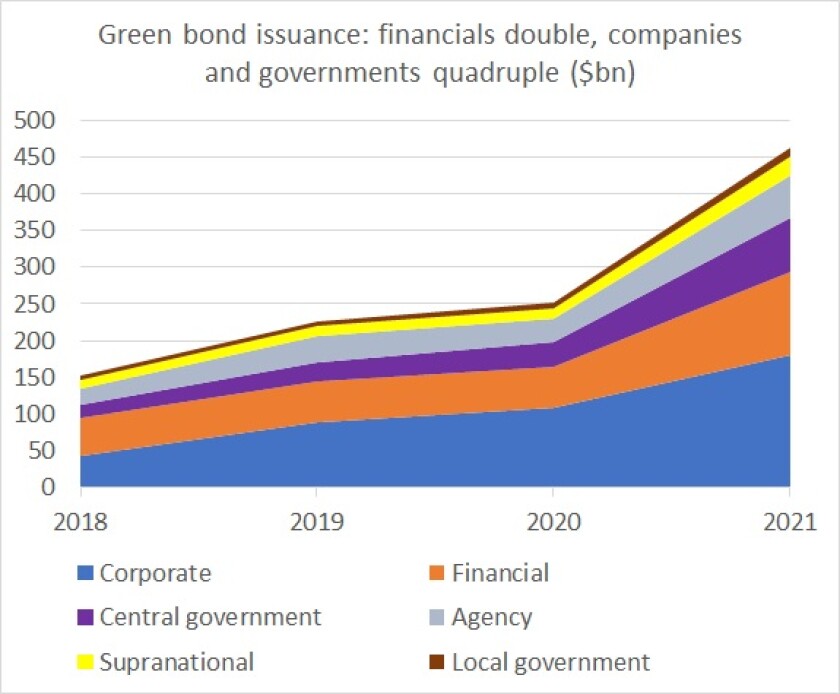

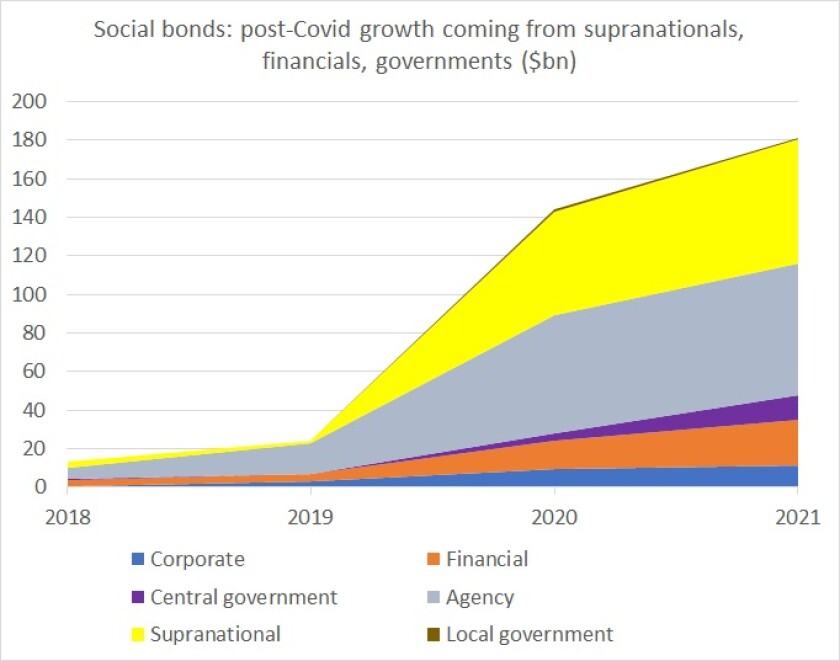

That anxiety has vanished. Since 2018, growth has become exponential, helped by a spreading acceptance of the techniques and the creation of new ones, such as the rapidly growing sustainability-linked loans and bonds. (Source for all graphs: GlobalCapital analysis of Dealogic data.)

“I expect we will see another growth wave in sustainable capital markets in 2022,” says Hans Biemans, head of sustainable markets at ING in Amsterdam. “Many issuers really want to jump on the wagon — ones that haven’t issued before.”

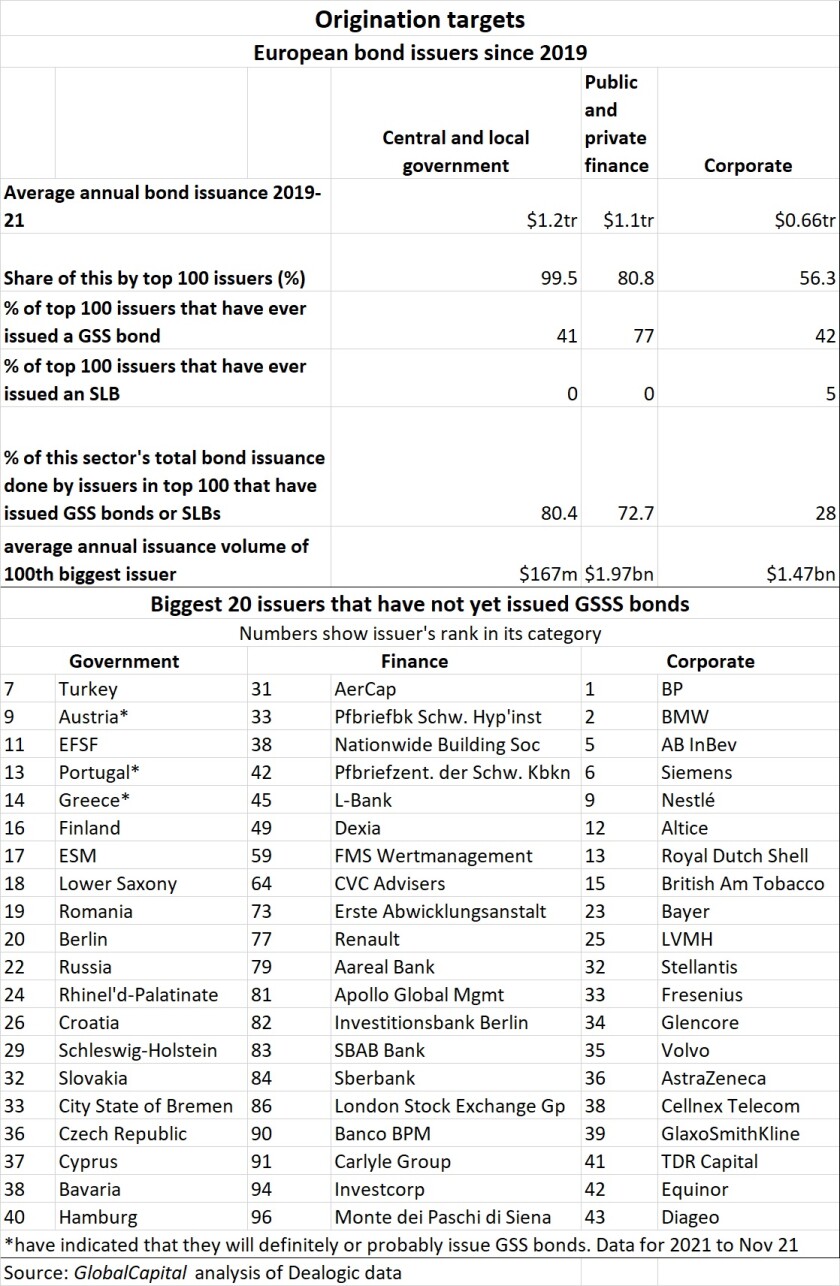

As GlobalCapital’s analysis of the top 100 European issuers in three sectors shows (see table), there are still plenty of organisations for banks to recruit to the sustainable finance banner, especially in the corporate world.

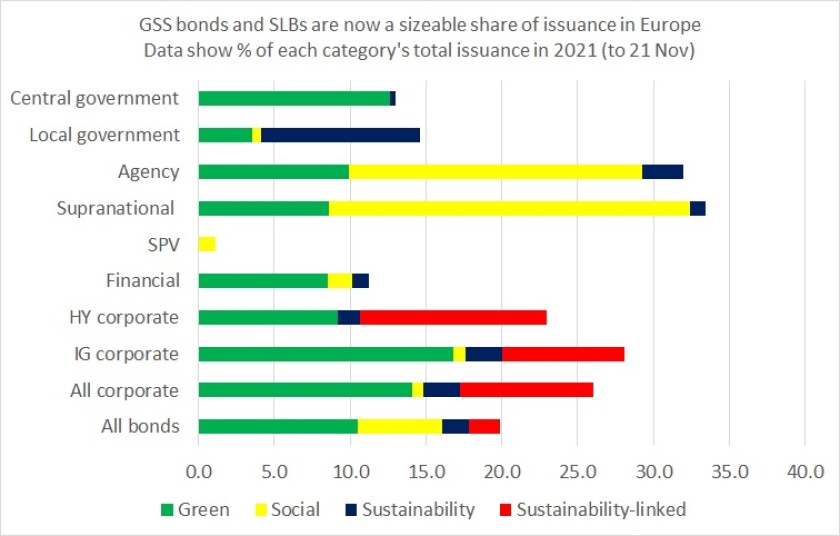

Bankers have begun to talk of a new metric: the share of issuance in a particular corner of the market that is green or sustainable. In several segments of the European bond market, that slice is now more than 25% (see graph).

“Common sense should be that the amount of sustainable investments is not endless,” says Biemans. “The percentage of the overall market is now a bit too high. It was healthier when not more than 10%-20% of the market was green, because green bonds should represent high ambition.”

Many market participants have given up predicting how big the market will get — but they are sure it will produce novelties. Agnès Gourc, co-head of sustainable financial markets at BNP Paribas in London, says: “Innovation is iterative. There is what we know today and how we apply it to other types of financial instruments.”

Asset-backed sustainability

Gourc is expecting an acceleration in sustainable securitization. “It has been discussed for so many years,” she says, but deals remain few and far between.

Potential issuers have lacked enough suitable green assets. But as data improves about domestic energy efficiency and homes become greener, lenders will build up a critical mass of green mortgages. Eventually, this could become a vast pool.

The same applies to car loans. Before Volkswagen issued its first green bond in 2020, its head of treasury told GlobalCapital VW would in due course use green finance, secured or unsecured, for car finance “but first we have to have a big portfolio of loans”.

In the first three quarters of 2021, it sold 293,000 electric vehicles, about 4.5% of total sales.

“In our market,” says Gourc, “it’s always chicken and egg — you need sufficient supply to have investors creating dedicated strategies. I find you can quite easily see when there is enough interest from issuers and investors for something to happen. It does feel like that is where we are.”

It is not just about asset accumulation, however. Market participants are trying to work out which structures will work best — whether use of proceeds or sustainability-linked formats.

“There is a lot of questioning in the market,” Gourc says. “A lot of banks and financial institutions do structure and lend sustainability-linked loans. What can you do with them?”

A CLO of SLLs — with full passthrough of the interest rate variability — is an intriguing prospect. But Gourc says “investors really need to have visibility on the SLLs. It’s not straightforward. You need to have something fairly homogeneous — for example, are they all based on carbon emissions KPIs?”

Bank of China made an experiment in that direction in October, by issuing a $300m three year unsecured bond whose coupon can be adjusted up or down by up to 5bp, depending on the margin variations of a reference portfolio of SLLs. Investors were told only basic facts about the assets, but the deal was popular — proving that buyers will accept at least a smidgeon of coupon step-down.

Another difficulty with such structures could be constructing an argument that the KPIs are material to the issuer, and ambitious.

SLBs’ unexplored potential

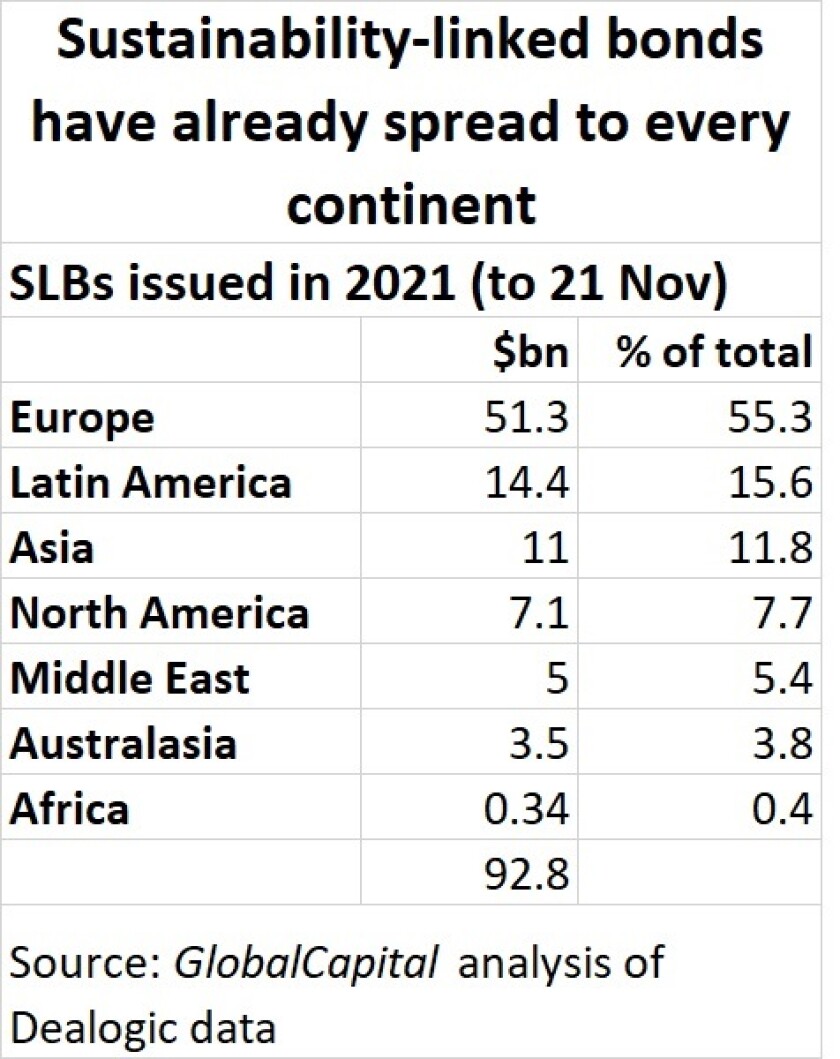

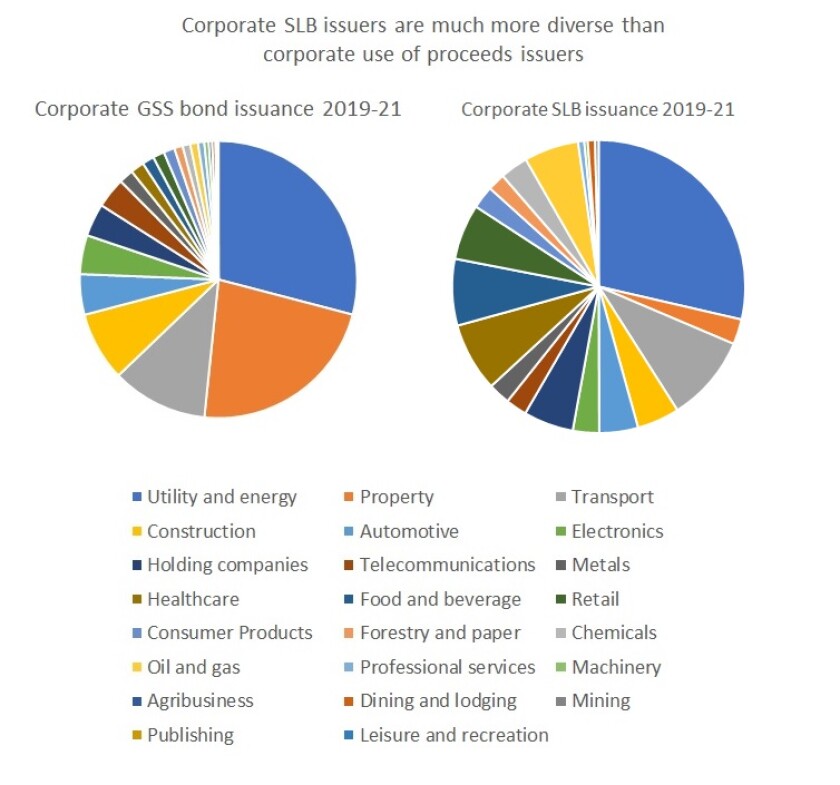

But the appeal of sustainability-linked bonds is undeniable. By the end of 2020, $11bn had been issued. In 2021 up to November 21, 126 issuers had sold $93bn — and they came from every continent and a remarkable variety of industries.

“Eleven percent of all the ESG bonds issued in 2021 have been SLBs,” says Gourc. “The overwhelming majority is from corporate issuers, so the big question will be: do we manage to expand them to other types of issuer? A large number of banks and insurance companies have joined net zero alliances. They are all coming out with tangible targets. So there is a range of KPIs that are really material for those issuers.”

Financial firms, on the whole, are very cautious about going public with short-term targets for decarbonising their portfolios. It still seems a stretch to think one would risk the even higher visibility of tying an SLB to such a goal. But Gourc says: “We do have a lot of discussions on it. To me, it’s a question of time.”

Sustainability-linked finance seemed simple when it was invented, but the more practitioners use it, the more paradoxes and conundrums it seems to throw up.

The central issue is the rigour of structures — how tough should the targets be, how much financial loss or gain should be at stake for borrower and lender, and what form of governance should keep the market honest.

Roland Mees, director in sustainable finance at ING in Amsterdam, predicts a flood of sustainability-linked and green loans. “We expect that sustainability-linked loans will become the new normal,” he says. “There is increasing peer pressure on companies to convert their revolving credit facilities to SLLs.”

But Mees is not rejoicing. “With growth of volumes there is also growth of risk of greenwashing,” he says. “These concerns are real — lack of quality is definitely a risk, because in all these instruments you choose the KPIs. The large corporates especially have leverage over the banks, which have a commercial incentive to accept the deal.”

He points to four weaknesses in particular. KPIs can address issues that are not very material to the issuer. Targets may not be ambitious enough — Mees has seen deals that require no more than what is legally obligatory.

All the difficult issues, for example in decarbonisation, may be postponed, and only the low-hanging fruit tackled now.

The fourth problem, Mees says, is “a minority of transactions where the premium or discount is being donated to charity. We think that is entirely misaligned with the principle of banking, which is about risk. ESG and credit risk are increasingly aligned and overlapping. S&P now talks about ESG credit factors.”

Any interest penalty should go to the lender, which may suffer higher credit risk if the borrower fails to hit its sustainability targets, Mees argues. Charity payments “disappear from banks’ reporting as well,” he adds.

“From a governance and transparency point of view, the bond market is ahead,” says Mees — because bond investors are at arm’s length from the issuer and will do it no favours, and the market requires second-party opinions. “On the other hand, unfortunately the SLB standards require only one KPI, whereas in the loan market we try to keep up a standard of at least three, which leads to at least equally solid frameworks.”

Mees is concerned that SLBs too often reduce discussion of sustainability to just greenhouse gas emissions.

Taxonomy tangles

The early years of green bonds were riven with anxiety about what was green. They still flourished, but the angst led to the EU driving a monster truck of regulation into the market. Front and centre is the Taxonomy of Sustainable Economic Activities.

Ironically, for an instrument designed to shed clarity and harmony, it has become ever more controversial and politicised. The outcome of wrangles between countries supporting the inclusion of gas, those backing nuclear power, and those wanting a “clean”, more scientifically based Taxonomy will be central to how the Taxonomy is perceived and used in 2022.

As companies begin to report what percentages of their revenues and capital and operating expenditure are sustainable according to the Taxonomy, many difficulties and unexpected consequences may result.

“It could be positive or negative,” Biemans says. “Companies will have the numbers at hand [on their green spending] to do a green bond or SLB. But if the percentages are very low, demand could dry up.”

A car manufacturer investing heavily to build up electric vehicle capacity might have plenty of sustainable capex, he argues — other companies might have only 1% or 2%, or belong to industries not yet described by the Taxonomy. Time will reveal whether investors will expect green bonds to be, say, 50% aligned with the Taxonomy, 25% or will accept even less.

Seeking the right path

Most in the market still believe that, overall, the Taxonomy and other regulations are a good thing. “Three to five years ago we were all talking about the need for harmonisation and standardisation, but it was only talk,” says Jacob Michaelsen, head of sustainable finance advisory at Nordea Markets in Copenhagen. “I’m very happy to see that we managed to follow up on that. Harmonisation and standardisation are happening all across the world.”

He points to the creation of the International Sustainability Standards Board, which is going to devise a global set of disclosure standards — beginning to integrate sustainability metrics into mainstream accounting.

Such standards will be a huge win for sustainable finance. But they will only describe reality as it is — not how fast organisations should change.

This quandary, which underlies the whole question of what is green, has been brought into keener focus by the SLL and SLB markets. To answer it, market participants are not turning to the Taxonomy or planning to rely on the EU’s promised label for SLBs.

“We’ve now had almost 15 years of green bonds, so every portfolio manager is quite familiar with them,” says Michaelsen. “You can take a framework to any investor and they can stay with you for the majority of the discussion. We’re not there yet with SLBs. For example, there are companies — such as dairy and meat processing or those where the use of their products require large amounts of electricity, such as mining equipment or elevators — which have 80% or 90% of their emissions in Scope 3. They can’t do much about it. What is the share of your emissions you need to cover in SLBs? PMs are now starting to get to grips with all these nuances.”

The tool lenders and borrowers are finding most helpful is Science-Based Targets. Launched in 2015, SBTs are an NGO-run scheme that assesses whether a company’s decarbonisation targets are ambitious enough, for a company in its sector, to be in line with what scientists say is necessary. “In 2020, after five years, the SBTi finally got to 1,000 companies,” says Michaelsen. “In 2021 we are already at 2,000. I expect this trend to continue on its exponential growth path.”

Behind that figure is the fact that a snowballing number of company leaders are now trying to manage their organisations in a systematic way towards net zero emissions. This growth, more than green finance volumes, is a truer cause for hope that the much-talked-of low carbon transition is beginning. GC