What a week in the US. A mob fitted out in fancy dress breaking into the Capitol building perhaps epitomised Donald Trump's presidency: a mix of the horrifying, sinister, tragic and farcical.

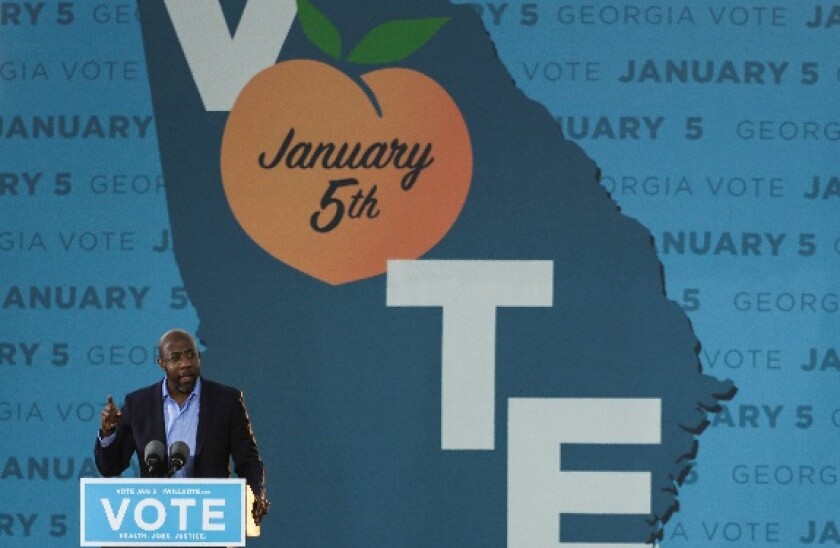

In the medium-term, what appears to matter more to investors is the victory of the two Democratic Senate candidates in Georgia, giving the party a (slim) majority in both houses.

"The near-term impact will be greater fiscal spending," according to Keith Wade, chief economist and strategist at Schroders. It is now more likely that Americans will receive another stimulus cheque.

"Looking further out, there is also the likelihood of an infrastructure bill with an emphasis on clean energy," said Wade. "However, we can also expect higher taxes particularly on the corporate sector, which will weigh on profits."

Schroders is increasing its economic growth forecasts for this year and next on the back of the news, and expecting an earlier hike from the Federal Reserve.

"Although the events of Wednesday night mean that risks remain over a smooth transition of power, the likelihood of a sharp V-shaped global recovery have increased," said Wade.

Politics is less dramatic on this side of the Atlantic, but countries are still grappling with the effect of the virus on the economy, and the roll-out of the vaccines.

The UK has decided to allow up to a 12 week gap between giving citizens the first and the second part of Oxford-AstraZeneca and Pfizer-BioNTech coronavirus vaccines rather than the recommended three or four weeks, and is not ruling out people being vaccinated with two different types of vaccines.

Helen Branswell at STAT explores the implications of this. Views differ among experts, who are weighing up the very high risks to vulnerable people right now, the risk of the vaccine being less effective with a longer wait, and also a fear that the policy could help the virus become resistant to vaccines.

Branswell writes that the UK will become "a living laboratory".

"If the efforts succeed, the world will have learned a great deal. If they fail, the world will also have gained important information, though some fear it could come at a high cost."

Finally, at Bruegel, Grégory Claeys, Mia Hoffmann and Guntram Wolff write about support for corporates during the pandemic. They say that so far in the current recession we have not witnessed an increase in business insolvencies in certain major economies.

Alongside other support programmes for firms, countries have changed bankruptcy rules temporarily, in order to lower the number of companies beginning insolvency procedures and avoid overwhelming courts.

The trio say that measures protected viable companies and prevented a ripple effect from closed firms and less jobs.

"In recessions like the current one, when insolvencies are concentrated in specific sectors, unemployment is even more persistent because sector-specific human capital slows labour reallocation," they say.

However, the common reservation about such measures is that they just delay companies that really shouldn't survive, in what is an inefficient use of resources for the overall economy.

"This problem is not new, and the debate on the zombification of some parts of the European economy started well before the Covid-19 crisis," write Claeys, Hoffmann and Wolff. "This has been amplified by the crisis but the main problem is that the unusual characteristics of this crisis make it extremely difficult to distinguish viable from unviable businesses in distress."

The trio recommend that policymakers continue support "as long as necessary" and prepare for "the wave of insolvencies that could quickly arrive once the current measures are lifted" amid rising corporate debt levels.

They also say that in the EU, the insolvency process is inefficient, with a lower recovery rate and a longer timescale than in the UK or US.