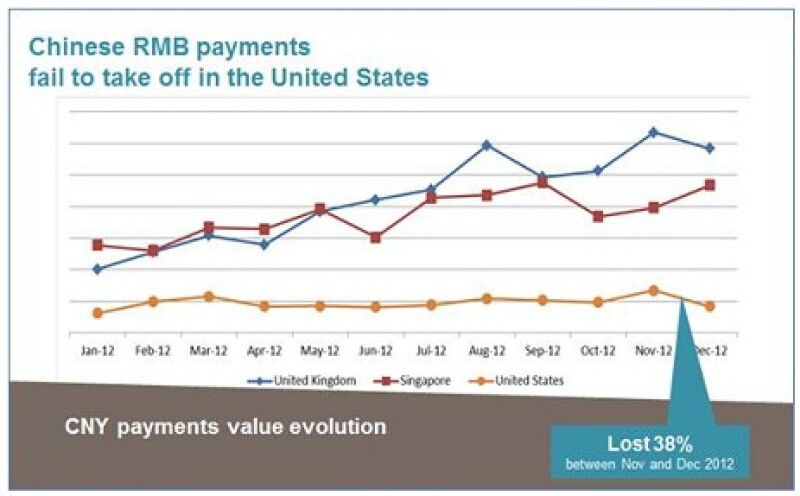

Renminbi adoption in the US showed a major decline at the end of 2012, with payments in the currency dropping 38% between November and December, according to Swift.

In December 2012, the United States represented 4.1% of renminbi (RMB) payments by value, versus 6.6% in November 2012, excluding China and Hong Kong. In December 2012, 95.5% of the payments value between the United States and China/Hong Kong was still performed in USD, with only 0.3% in RMB. For 2012 overall, RMB payments in the US were flat.

The drop pushed the US down three positions to number six for countries using the offshore renminbi. The top five countries for renminbi payments are now United Kingdom, Singapore, Australia, France and Luxembourg, according to Swift data.

“We expect that most US flows we currently see in RMB are non-trade related and are subject to more variability than countries with strong underlying trade flows like Europe so this is not unexpected,” said Lisa O’Connor, RMB Director for Swift. “RMB as an invoicing currency between the US and China needs to overcome a number of challenges including inertia and systems set up to invoice only in USD.”

Overall, RMB payments decreased by 4.2% between November 2012 and December 2012, versus an average decrease of 5.7% across all currencies. Despite this, the RMB remains the 14th most used world currency with an all-time high market share of 0.57% in Swift payments, versus 0.56% in November 2012.