Covered Bonds

-

The conditional pass through covered bond (CPTCB) has potential to become more widespread, said bankers in the aftermath of Moody’s detailed overview of the structure that was published this week. They noted that a new issuer is currently considering employing the structure, backed by a varied pool of international assets.

-

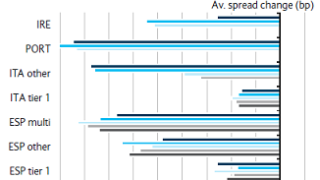

The more modest year-to-date tightening of Irish covered bonds relative to other peripheral jurisdictions has created a value opportunity, says Barclays research, which recommended buying Irish covered bonds versus Irish government bonds. However, traders say limited liquidity in the secondary market for peripheral names means that the trade idea will be difficult to executive in practice.

-

Jochen Hartlieb has joined IKB Deutsche Industriebank from Bayerische Landesbank.

-

After issuing its second covered bond of the year on Tuesday, Crédit Foncier de France is set to return to the capital markets and fund its residential mortgages with an RMBS, the first sale of the product from France since 2006. But in contrast to covered bonds, the RMBS is driven by capital considerations with the leads confirming that the issuer intends to place all of the subordinated notes.

-

Italian banks' repayments of liquidity drawn under the European Central Bank’s (ECB) long-term refinancing operation (LTRO) have been slower than in most other European countries, said Fitch on Wednesday. Analysts say Italy’s smaller banks are going to be increasingly incentivised to term out ECB liquidity with publicly syndicated covered bond issuance, but with stress test results due in October, time is running out.

-

The Bank of England said on Tuesday that it would include covered bonds into its stress test of UK banks, in contrast the European Banking Authority, which did not specifically mention covered bonds.

-

The Bank of Montreal (BMO) became the sixth Canadian bank to issue legislative covered bonds when it opened books for its first legislative deal on Tuesday. The transaction was priced at the tight end of the range of Canadian deals and encountered some price sensitivity but was still comfortably oversubscribed.

-

Compagnie de Financement Foncier (CFF) came to market with its second Obligation Foncière of the year on Tuesday, matching the March deal’s €1bn size but this time opting for a 10 year, rather than five year, tenor.

-

The market sprang back to life on Monday with Bank of Montreal mandating Barclays, BMO Capital Markets, Commerzbank and HSBC to lead its inaugural covered bond transaction, which is a euro-denominated deal targeted for launch and pricing on Tuesday. The tenor is yet to be determined.

-

Packed with new data and features, Société Générale and Global Capital proudly present the 2014 edition our flagship map. Click on the image below to view,

-

Core trading volume was light on Friday morning, but negative momentum in Cédulas resurfaced. The bonds continue to suffer broadly on the back of a downgrade of nine deals to below investment grade by Standard & Poor’s on April 15.

-

Banking funding rules should have diversity and stability in mind, and steer clear of favouring one funding format over another. But a Basel consultation document on the Net Stable Funding Ratio published this month, promotes the exact opposite, and will make bank funding less stable.