Covered Bonds

-

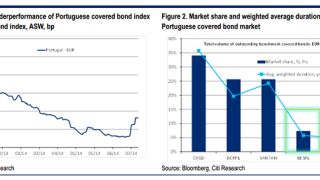

Pimco, after staying clear of Portuguese bank or sovereign debt for five years, was in Lisbon at the end of last week to investigate opportunities in the troubled country generated by the ongoing Banco Espirito Santo (BES) debacle. The meetings came as several sellside research analysts tipped Portuguese covered bonds as a good relative value opportunity versus periphery peers.

-

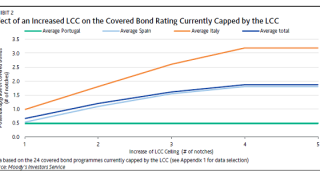

The ratings of 24 covered bond programmes from across the EMEA region could be up to four notches higher without the constraint of sub triple-A local currency country risk ceilings (LCC), according to a Moody's analysis on Tuesday.

-

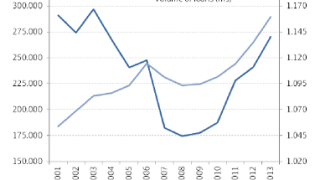

Growing demand for real estate finance in Germany is likely to trigger growth in mortgage Pfandbrief issuance over the medium term, said NordLB covered bond analysts in a recent briefing paper after outstanding mortage Pfandbrief volumes fell in 2013.

-

Deutsche Hypothekenbank, NordLB’s commercial real estate subsidiary, opened books on Monday for its first Pfandbrief of the year. This is the first time for more than four years that a German issuer has priced a deal in the second half of July but leads still attracted a heavily oversubscribed order book.

-

Pimco, after staying clear of Portuguese bank or sovereign debt for five years — was in Lisbon recently to investigate opportunities in the troubled peripheral jurisdiction generated by the ongoing Banco Espirito Santo (BES) headlines. The meetings came as several sell-side research analysts tipped Portuguese covered bonds as a good relative value opportunity versus periphery peers.

-

The rating of 24 covered bond programmes from across EMEA could be up to four notches higher without the constraint of sub triple-A local currency country risk ceiling (LCC), analysis from Moody’s revealed on Tuesday. Within a given jurisdiction, the risk ceiling defines the highest rating achievable for an issuer’s print in the local currency.

-

Deutsche Hypothekenbank, NordLB’s commercial real estate subsidiary, opened books on Monday for its first Pfandbrief of the year. Despite the time of year – this deal is the first German issuer to price a deal in the second half of July for over four years – leads attracted a heavily oversubscribed order book. Credit market conditions in the Euro area provided a constructive backdrop for execution, with Bunds stable and periphery markets recovering.

-

Toronto Dominion’s first legally compliant covered bond stormed the market on Monday morning, raising €1.75bn – €750m more than any of the other five Canadian euro benchmarks that have been launched this year.

-

We are delighted to announce voting for The Cover’s 2014 awards has started.

-

Christoph Anhamm, RBS's head of covered bond origination, is leaving the bank to take up a broader position at ABN Amro, GlobalCapital understands. Tim Skeet is said to be taking over the position at RBS.

-

The five year area of the covered bond curve saw solid demand in the secondary market this week, especially for bonds originated from outside the European Economic Area (EEA). The rally was driven by speculation that a recent proposed change to the liquidity coverage ratio (LCR), which would allow banks to count such bonds in their liquidity buffers, could be approved.

-

The first draft of the Pfandbrief Act 2015 offers some remarkable novelties, according to Commerzbank research, which said in its latest weekly publication that proposed changes should not cause any headaches — and may even improve transparency. Moody’s agreed saying that the draft proposals were credit positive.