Covered Bonds

-

Moody’s finally got round to taking rating action on over 40 Spanish multi-Cédulas covered bonds on Friday — some two years after putting them on review for downgrade. By biding its time the agency avoided the harsh downgrades to junk many had feared would cause forced selling.

-

Moody’s upgrade of Portugal bodes well for prospective covered bond upgrades and should help to limit contagion related to the troubled Portuguese lender, Banco Espírito Santo, said bankers.

-

232 people have responded so far to The Cover’s 2014 awards survey with as many as half being investors. The final results will be revealed in late September, but the preliminary outcome based on the un-weighted vote shows that the margin separating the top institutions and deals is thin in many categories, including prestigious awards such as Best Global House.

-

Covered bonds are likely to be so well ring-fenced from a regulatory perspective compared to other forms of bank debt that it makes sense to delink the asset class from the rest of the bank credit universe, a major investor told The Cover on Thursday.

-

BNP Paribas faced the wrath of the covered bond market this week after successfully placing a debut trade for Banca Popolare di Sondrio (BPS). Despite the €500m five year attracting more than 50 orders, worth €1.1bn, not one rival banker or investor had a good word to say about the syndication.

-

BNP Paribas syndicate dismissed talk on Wednesday of untoward motives around its role as sole lead in the inaugural deal issued by Banca Popolare di Sondrio on Tuesday. The market’s approach to syndication is overly formulaic, it said. (This article has one comment)

-

RBS announced several proposals related to the swap triggers in its covered bond programme after being downgraded by Moody’s. The plans, which will be subject to an investor vote, will allow RBS to remain the swap counterparty and thereby help it to avoid the higher cost of employing an alternative swap provider as was envisaged under the original swap agreement.

-

Banca Popolare di Sondrio surprised the market on Tuesday, announcing and pricing its inaugural Obbligazioni Bancarie Garantite via sole lead BNP Paribas. The newcomer which is a slightly larger institution than its more established covered bond peer, Credito Emiliano, offered a deal with a substantial spread pick up enticing a broad swathe of investors. (This article has one comment)

-

Implementation of the liquidity coverage ratio (LCR) is set to be delayed by 10 months according to a draft document from European Commission (EC) leaked last week. The leaked draft contained good news for covered bonds, but did not improve the position of ABS, which the European Central Bank and Bank of England will want to see changed, said bankers on Monday.

-

Moody’s upgrade of Portugal last Friday bodes well for the prospective upgrade of the covered bonds issued by Santander Totta, said analysts on Monday. It should also help to limit covered bond contagion spreading to other lenders, in the event of further negative headlines emerging related to the troubled Portuguese lender, Banco Espirito Santo (BES).

-

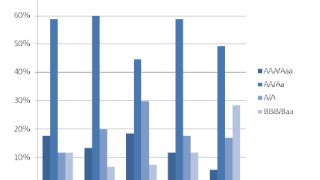

Appetite for risk in the covered bond market has risen markedly over the last two years, according to a survey of the 180 German investors who attended NordLB’s global capital markets conference on July 17. (This article has one comment)

-

Toronto Dominion’s first legally compliant covered bond stormed the market on Monday morning, raising €1.75bn — €750m more than any of the other five Canadian euro covered bond benchmarks that have been launched this year, and the joint largest euro deal of the year.