Covered Bonds

-

A pickup in primary market activity continued apace on Wednesday when Stadshypotek sold the sixth dollar denominated covered bond in the US this year.

-

Northern Rock Asset Management (NRAM) made a tender offer for its €2bn 3.875% November 2020 covered bond and intends to pay a 2% tender premium if investors surrender their notes before 4pm on April 17.

-

The Austrian state of Carinthia announced that it will provide a line of liquidity support to Austria’s Pfandbriefstelle suggesting a slight improvement in the negative political backdrop dominating the Austrian banking sector.

-

Sentiment improved in covered bonds this week, mirroring the better backdrop in credit markets. Two German issuers found solid demand for their deals, in contrast to the previous week when issuers had struggled to sell bonds. Both this week’s trades were in the intermediate sector, in contrast previous deals which had been in the oversupplied long end of the curve.

-

The spread between the weakest and strongest covered bonds is tighter than at any point in the last five years, thanks to the European Central Bank’s backstop bid. But just because the ECB is willing to buy anything and everything that qualifies as a covered bond, that doesn’t mean investors should.

-

At the end of April Standard & Poor’s will roll outs its new multi Cédulas (MC) rating methodology. It expects 40% of deals it rates to be downgraded two to three notches and 40% to be upgraded about two notches. At the same time it will implement its European commercial real estate (CRE) rating criteria, which will result in 10% of covered bonds with commercial real estate in the pool being downgraded by one notch and no upgrades.

-

The spread between the weakest and strongest covered bonds is tighter than at any point in the last five years, thanks to the European Central Bank’s backstop bid. But just because the ECB is willing to buy anything and everything that qualifies as a covered bond, that doesn’t mean investors should.

-

The Austrian state of Carinthia announced that it will provide a line of liquidity support to Austria’s Pfandbriefstelle. The decision suggests a slight improvement in the negative political backdrop dominating Austrian banks. Despite continued concerns, the recent sell-off has thrown up relative value opportunities, said analysts.

-

HVB returned to the covered bond market for its first and only mortgage-backed covered bond benchmark of the year on Tuesday and enjoyed a solid reception. The choice of tenor, deal size and timing all played important roles in the deal’s success.

-

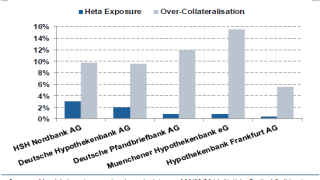

The decision to remove Heta exposure from Pfandbriefe collateral pools and add substitute assets has strengthened the position of investors and has demonstrated the importance that the German banking industry places on the reputation of the Pfandbrief product, said Moody’s on Monday.

-

Sentiment improved across the board on Monday, and especially in the covered bond market where Commerzbank issued an oversubscribed seven year tap which it increased from the minimum size during bookbuilding. The increase made a stark contrast to last week’s deals and suggests scope for another transaction on Tuesday. Despite a very supportive technical backdrop, the second quarter outlook is less certain with concern over Greece set to mount, said bankers.

-

Northern Rock Asset Management (NRAM) made a tender offer for its €2bn 3.875% November 2020 on Monday and will pay a 2% premium. The bank has also proposed an extraordinary resolution to redeem all notes other than those tendered, for which it will not pay a premium.