Covered Bonds

-

Benchmark euro covered bond issuance from a core borrower is expected soon after Rabobank and Swedbank reopened the senior market. Meanwhile, DNB Boligkreditt followed ANZ into the dollar 144A market on Wednesday with a similarly sized deal, in the same tenor and at the same price.

-

The European Central Bank has expressed concern about extreme rates volatility. But until it stops buying and allows the private sector to become re-established, its true mission as liquidity provider of last resort will remain in conflict with its determination to expand its balance sheet.

-

The dollar market continued to sustain covered bonds on Wednesday as DNB mandated leads for a five year, a day after ANZ issued $1.25bn in the same tenor. The Australian bank got better execution than would have been achieved in euros and could have priced even tighter. The excellent result is testimony to the issuer’s long absence and to the depth of demand evident across the dollar fixed income market.

-

NordLB reopened its four year public sector backed Pfandbrief on Wednesday in a move which locks in cheap funding. But the 10bp yield offers little buffer in a market characterised by rate volatility.

-

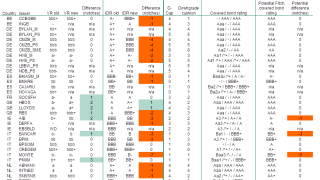

On Tuesday evening Fitch downgraded a swathe of European bank ratings, as it no longer gives any benefit to systemic state support. The downgrades were not expected to have much impact on covered bonds, but a few programmes may be hit. The most extreme case is likely to be Banca Monte dei Paschi di Siena (BMPS), whose July 2024s widened 50p.

-

The Bank Recovery and Resolution Directive was supposed to be universally good for covered bonds because they are excluded from being bailed in. But on Wednesday and Thursday Moody’s and Fitch took opposing views on Allied Irish Banks due to the implementation of their methodologies that take account of the same new regime.

-

The European Central Bank has expressed concern about extreme rates volatility. But until it stops buying and allows the private sector to become re-established, its true mission as liquidity provider of last resort will remain in conflict with its determination to expand its balance sheet.

-

Torrid market conditions have kept issuers away from the euro benchmark market since April 29, forcing borrows to consider alternative currencies. On Tuesday, Abbey printed a £500m three year sterling deal, and even though the deal was not subscribed, bankers felt the sterling market was still open. Separately, ANZ has mandated leads for the second dollar benchmark from Australia this year.

-

Ålandsbanken priced a €250m no-grow five year Finnish covered bond on Tuesday after an extensive marketing period. The trade offered a decent pick up over where the comparables named by the leads were quoted.

-

Achmea Bank has priced its first RMBS of the year, Virgin Money has announced a mandate for a new UK RMBS and another issuer is planning to sell the full capital structure of an RMBS backed by Irish mortgages.

-

European Central Bank board member, Benoît Coeuré, has acknowledged that extreme volatility is a worrying sign of reduced liquidity. But even so, the central bank will step up its purchasing in a move that is expected to accelerate the exodus of real money demand from covered bonds. These investors will be the slowest to return when buying eventually stops. This will hit peripheral issuers the hardest, said analysts at Crédit Agricole CIB research.

-

Leads KSK Koeln, LBBW, and WGZ opened books on an €250m eight year Pfandbrief for Kreissparkasse Koeln (KSK Koeln) on Monday as Bund futures showed signs of stability. Nordic issuers are circling and could take advantage of better conditions ahead of an EU meeting on Greece at the end of this week.