Covered Bonds

-

CBIC has responded to the European Commission’s consultation on covered bonds with a host of recommendations on transparency. It has requested further improvements to the European Covered Bond Council’s Harmonised Transparency Template (HTT).

-

DBS Bank issued its first benchmark covered bond in Australian dollars and the first from an Asian issuer on Wednesday. The A$750m three year attracted a deep and broad book of demand, sending a positive signal for other potential Aussie dollar covered bond issuers.

-

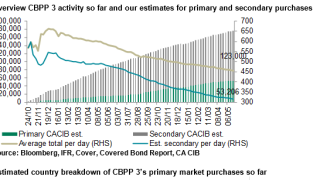

The European Central Bank has stepped back covered bond purchases despite much higher supply so far this year compared to last.

-

NIBC Bank issued the longest ever maturing conditional pass-through (CPT) covered bond from a bank in Europe’s core on Tuesday. The granular order book and modest new issue concession suggested that market conditions have stayed strong.

-

Dutch issuer Obvion is launching the world’s first green RMBS deal, backed by a €271m portfolio of loans on prime energy efficient homes.

-

NIBC has mandated leads for a 10 year conditional pass through covered bond (CPT), the longest ever seen from a Dutch bank. The issuer follows Aegon Bank which last week saw exceptionally strong demand for its €500m seven year.

-

Bank of New Zealand has mandated leads to roadshow its first euro benchmark in four years. It joins Westpac New Zealand and SR Boligkreditt which are also marketing deals.

-

UK banks Santander and TSB issued prime RMBS on Thursday and Friday last week, respectively. Meanwhile, UK Mortgages Limited has announced a third RMBS backed by mortgages originated by Coventry Building Society.

-

Banca Carige may follow the example of Portugal’s Montepio, which on Friday said it would restructure its covered bond programme to a conditional pass-through (CPT), resulting in a three notch upgrade. The Italian bank’s bonds were junked by Fitch on Thursday, and with access to primary markets at risk, it may copy Monte dei Paschi Siena which switched to a CPT last year.

-

Moody’s has talked up the positive credit aspects of Turkish covered bonds in an in-depth report which it published on Thursday. However the agency says Turkish covered bonds remain susceptible to tail event risks such as the political environment — a point which locals dispute.

-

Singapore's DBS is looking to expand its covered bond investor base and has now set its sights on an Australian dollar offering.

-

Norwegian issuer SR Boligkreditt and New Zealand borrower Westpac NZ will both take new euro deals on the road before the end of May, and the UK’s TSB has confirmed covered bonds will form part of its long term funding.