Intesa Sanpaolo

-

◆ Hesse prints largest European regional green bond ◆ ESM builds 'massive' book ◆ CDP tightens pricing by 6bp

-

European banks progress with capital raising as spreads tighten, but investor qualms grow

-

◆ Italian bank raises €1bn after a similar euro pair last week ◆ Year-to-date euro AT1 new issuance volume is almost a quarter higher than 2024 ◆ Deal completed with minimal new issue premium

-

◆ Scarcity value helps insurer 'stand out from crowd' ◆ Maturity and credit 'a different animal' from parent ◆ Pricing versus parent company evaluated

-

◆ Skinny new issue premium ◆ Deal 10 times covered ◆ Pricing with EU not a challenge

-

Conclusive US election result and rate product woes open pre-funding options to banks

-

◆ Multiple factors lure buyers to rare deal in the asset class... ◆... after strong credit rally following US elections ◆ Positive new issue premium reinstated

-

◆ Big orders and minimal premium for senior sale ◆ NatWest brings affordable housing bond ◆ Dutch debut from Triodos

-

More than 12 regional and global banks joined the facility as Middle Eastern companies find M&A appetite

-

◆ Italian bank prints at 7% amid 'Fomo' for AT1 refi ◆ Tier two capital well absorbed with rare Munich Re offering €1.5bn ◆ AIB benefits from green label

-

‘Generational change’ includes new CFO, deputy CFO and head of funding

-

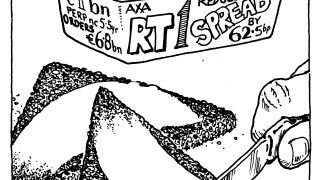

Order books shrink when issuers tighten pricing as investor expectations of rate cuts shift