US dollar

-

◆ First euro AT1 for more than two months as Santander, other G-Sibs went for cheaper dollars ◆ Non-national champion status makes it 'not straightforward' execution ◆ Ongoing strong bid for yield

-

Issuance opportunities abound across capital stack but borrowers said to be happy to wait for deeper liquidity

-

◆ Issuer stays in senior format as European peers opt for raising AT1 capital ◆ State Street adds rare tier two to funding mix ◆ Conducive market may stretch FIG issuance after Thanksgiving into December

-

◆ Fourth deal in a little over a week will add to $6.5bn of AT1 issuance ◆ Comes just a day after Barclays garnered huge response for its tightly priced trade ◆ Santander seen focusing on achieving lower yield

-

◆ Issuer takes advantage of red-hot sentiment post-CPI ◆ Higher yielding bank capital prices moved up, including a similar AT1 from Barclays ◆ Strong demand suggests tight pricing eyed

-

US dollar market helped the province to raise an equivalent of five to six domestic bonds

-

Issuer defies risk aversion to duration in 'narrow window'

-

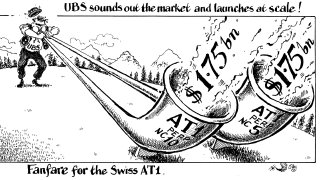

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears

-

◆ First AT1 for nearly two months after volatility ◆ Priced flat to or inside fair value ◆ Head of funding says deal could have been bigger

-

Issuers take every opportunity to print as market turns tougher

-

◆ SocGen and especially UBS garner huge demand for high yielding AT1s ◆ Red-hot interest suggests more European banks could issue in subordinated Yankees ◆ HSBC and BBVA raise $2.75bn in tier two

-

Sovereign led a busy week for SSA issuance in dollars with $9.25bn raised