Top Section/Ad

Top Section/Ad

Most recent

The Swiss bank posted the biggest quarterly profit on record thanks to an accounting gain related to its acquisition of Credit Suisse, but weak performance at its former rival hints at a long road back to growth

Imminent half year results will reveal whether the new Swiss bank is a hastily patched monster or a new financial powerhouse

Banks are determined to stick to their growth plans as they see cause for optimism in investment banking thanks to increasing confidence and a growing pipeline of deals

Wall Street is urging the Fed to be cautious despite the regulator hinting higher capital requirements are coming

More articles/Ad

More articles/Ad

More articles

-

Pay is likely to be under pressure at Morgan Stanley, as the firm shrank its compensation costs from $2.4bn in 2014 to $1.4bn last year in its Institutional Securities division.

-

Markets and banking helped drive Citi’s better-than-expected fourth quarter earnings, but the results still failed to convince investors that the bank has a clear path to growth.

-

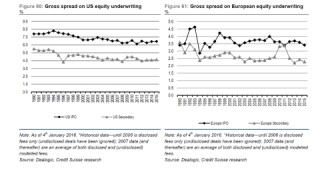

After a year when European banks took their lowest ever share of investment banking fees, 2016 is not shaping up to be much better. Credit Suisse’s bank analysts noted continued low fees in the European market, which is set to continue into 2016 and 2017.

-

JP Morgan’s corporate and investment bank (CIB) reported an 80% increase in profit in the fourth quarter, as the division’s legal fees and compensation dropped 20%.

-

UniCredit’s profits took a 30% hit in the third quarter, but the drop in core bank earnings was far more modest and its investment bank posted a year-on-year increase.

-

BNP Paribas defied the gloom that characterised the third quarter investment banking revenues reported by its French peers over the last week, all of which posted revenue falls in their investment banking divisions.