Latin America

-

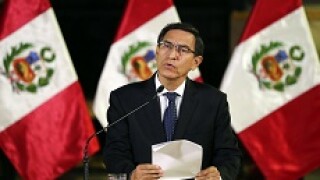

Latin America equity and bond investors have been left to consider the cost of political volatility in Peru, after the relationship between the country’s president Martín Vizcarra and its congress completely broke down on Monday.

-

Promigas, the Colombian natural gas distribution company, is hitting the road with a debut senior unsecured dollar bond offering.

-

Delta, the US airline, announced last week that it had struck a deal with LATAM, the largest airline in Latin America, in a deal which it expects to finance in the bond market.

-

Mexican payroll lender Crédito Real brought Latin American high yield corporate issuance back to the European bond markets for the first time in five years last week, in a deal that fed euro buyers’ hunger for new names.

-

Lat Am syndicate bankers were in bullish mood after Brazilian petrochemicals company Unigel clinched a seven year bond to complete a diverse few days of issuance from the region.

-

Interbank showed off the prowess of Peruvian issuers in international bond markets on Thursday as it topped up a dollar deal from the previous day with a nuevo sol tranche.

-

Ecuador sold $2bn of bonds on Tuesday in a surprisingly timed deal that triggered a sell-off in its existing bonds as analysts said the deal suggested the country’s fiscal adjustment was slower than expected.

-

Uruguay made the most of the low rate environment on Thursday to tap two bonds for a total of $1.055bn. It was part of a liability management exercise that the finance ministry said produced a nominal financial benefit of $87m.

-

UniCredit forms sustainability team — UBS looks to raise game in green with SEB hire — SG reshuffles Paris ECM line-up

-

Stifel Nicolaus & Co, the brokerage and investment banking firm, has hired a head of emerging markets sovereign research from Oppenheimer & Co, GlobalCapital understands.

-

Peruvian lender Interbank issued $400m of bonds to buy back existing debt on Wednesday, and may also price global local currency notes.

-

Uruguay added $750m to bonds maturing in 2055 on Tuesday and looks set to increase its 2031s on Wednesday as part of a liability management exercise.