Derivs - Interest Rate

-

Five years after being pushed on to trading venues in the US by the Dodd-Frank Act, over-the-counter derivatives players are beating a similar path in Europe, under the Markets in Financial Instruments Directive II. Most people think MiFID II has been a worse experience, and will make it harder for small players. But efficiency gains may follow. Ross Lancaster reports.

-

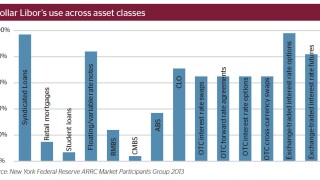

It is six months since Andrew Bailey, head of the UK financial regulator, set the clock ticking on a transition from the London interbank offered rate to an alternative. But if credible replacements are to be ready by his 2021 deadline, there is still a mountain of work to do. Ross Lancaster explores the risks of phasing out the old benchmark and asks if it could yet survive.

-

The Wholesale Market Brokers' Association on Wednesday announced that it had changed its name to the European Venues and Intermediaries Association, to better represent the market infrastructure its members operate.

-

The standoff on international securities identification numbers (ISINs) between derivatives trading platforms and the Derivatives Service Bureau (DSB) has been partly resolved, but resentment is still strong about how this part of the Markets in Financial Instruments Directive has been implemented.

-

The end of pension scheme arrangements’ (PSAs) clearing exemption is approaching, but European Union institutions and market participants are still forcefully debating whether to grant another rollover — and what a permanent solution will look like.

-

TruePTS, the post-trade processing arm of interest rate swaps platform TrueEx, has signed up two banks to its service, less than a fortnight after putting a legal dispute behind it.

-

The European Commission’s formal recognition of US derivative trading platforms this week had been in the pipeline for some time. But at a time of so much global friction, it was welcome good news.

-

LCH has added more Australian dollar lines to its clearing business in the market, including Australian dollar bank bill reference rate (BBSW) against Aonia overnight basis swaps in its product range.

-

Crédit Agricole has added to the momentum in systematic internaliser sign up, joining other banks in registering as one well ahead of a 2018 deadline.

-

European regulators gave cross-border derivatives traders a long-awaited relief this week when they formally recognised some US derivatives platforms’ eligibility for the trading obligation, which obliges over-the-counter trading in liquid derivatives to migrate onto trading venues.

-

Eurex Clearing on Tuesday announced that five execution platforms will support a new partnership programme, as it tries to wrest interest rate swap clearing business from London.

-

A legal battle between TrueEX and MarkitSERV has come to a close, with the two parties agreeing to resolve their dispute over the use of post-trade interest rate swap processing services.