Covered Bonds

-

A covered bond deal a possibility and spreads recover slightly but little incentive for most deals after 'wild' morning

-

Supply could quickly resume if conditions stabilise

-

FIG issuance plans for next week in doubt after Friday 'meltdown'

-

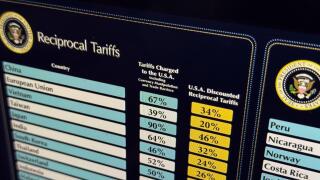

◆ How US tariffs will affect bond issuers in the medium and long term◆ Liberation Day: your funniest quotes ◆ A funding update from KfW's head of capital markets, Petra Wehlert

-

FIG and EM cover ratios fall while other markets rise

-

Trading activity and primary performance show covered bond robustness

-

◆ Finnish deal delivers size ◆ Trade already spotted tighter in secondary ◆ Finnish supply lagging 2024 year to date

-

◆ Shorter deal proves more popular ◆ Both tranches price near the same Bund spread ◆ Small pick up to Länder offered

-

◆ Tight deal needed no premium ◆ New investors buy the name ◆ Some short-dated covered bonds now trading through Länder

-

◆ Dutch bank scoops €1.5bn with three year deal ◆ Demand allows for tight pricing ◆ Next to no premium needed

-

◆ Book holds together despite strong spread revision ◆ No concession needed for popular print ◆ Investors find safe haven in covered bonds

-

◆ Deal demand shows covered bonds ability to withstand volatility ◆ No concession needed ◆ French deal lands through OATs