Covered Bonds

-

Coventry Building Society’s deal attracted the most demand despite concerns over LCR status

-

NordLB scored its largest order book on Monday as investors flocked to covered bonds

-

The issuer did not need the funding but was keen to establish a strategic presence

-

Aareal and Macquarie hauled in less demand for shorter deals

-

Better repo terms would trigger race for high quality collateral

-

RBC, ING Diba, BSH and Danske pre-fund in size in case market conditions deteriorate

-

More issuance is on the horizon as Bausparkasse Schwäbisch Hall and ING-DiBa mandate deals and non-eurozone banks eye funding too

-

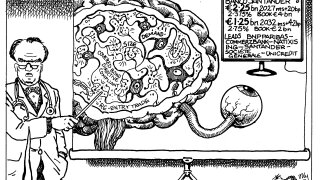

A tale of two FIG markets: covered bonds are tightening and collateral will be freed up

-

Austrian covered bond issuance has sharply increased in 2022

-

UK issuers wanting to avoid regulatory uncertainty in euros are expected to switch to sterling

-

The two-part deal was a ‘no-brainer’ due to its generous pick-up and high yield

-

Recent new issues have performed well but sentiment set to turn bearish