Cover story

-

One of China’s largest developers seeks to restructure offshore debt as market hunkers down for more bad news from the sector

-

Higher funding cost is making compounded Sofr more appealing for its hedging opportunities

-

New issue concessions rising as inflation soars

-

New deals emerge amid hopes of improving sentiment after rate hike and support for China’s tech sector

-

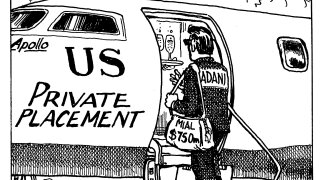

Uncertain market conditions are prompting issuers to hunt down different ways to raise money

-

The primary leveraged finance market is beginning to churn out deals again. The first European high yield deal in 10 weeks is expected to be priced this week and a handful of leveraged loans have begun the pricing process.

-

Domestic deal flow for the sector slows this year but offshore activity picks up

-

Issuer’s choice of price over size amid weak markets led to investor pushback

-

Chinese company's bond structure may be replicated by peers, albeit with some caveats

-

CBs are one of the few viable fundraising options as confidence slumps across ECM and DCM

-

Deal activity slowly picks up, but Asia’s high yield market struggles to stay open

-

As the Chinese economy faces growing headwinds, market expectations for more stimulus measures rise