Banks

-

-

Bank’s restructuring will improve the fortunes of its investment banking business while also allowing the group it to navigate geopolitical tensions

-

Sponsored by Lloyds BankAnthony Bryson, CEO, Lloyds Bank Capital Markets Wertpapierhandelsbank, FrankfurtWilliam Mansfield, CEO & Country Head, Lloyds Bank North America, New York

-

◆ Swap spread moves help issuer's spread to US Treasuries ◆ No-grow deal many times covered ◆ Investors expecting rate cuts turning to short end yields

-

◆ Pricing below 100bp was debated ◆ Trade gained from sterling technicals ◆ Recent steepening means some issuers cautious about duration

-

◆ Deal priced at same spread as Baden-Württemberg ◆ Pricing in high-20s versus swaps is new reality ◆ Länder spreads versus KfW remain intact

-

◆ Deal's reception 'exceeded all expectations' ◆ Final €2.75bn book a large one for Länder sector ◆ Curves of other German states and KfW referenced

-

◆ Deal thought to be KfW's dollar benchmark finale for year ◆ Tight Treasury pricing beats World Bank's 6.9bp record spread ◆ Issuer has no need for a big benchmark

-

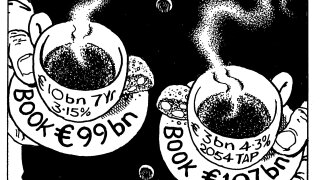

◆ Dual-tranche deal attracts €200bn of orders ◆ New seven year was somewhat unexpected ◆ Bookbuilding started with 4bp of premium

-

◆ Rarity, tenor and size fuel demand ◆ Big book and dozen dealers make allocations tricky ◆ Next to nothing paid in premium

-

New chief executive makes first reorganisation with some senior bankers understood to be leaving

-

◆ US bank brings sizeable sterling deal ◆ Fair value debated ◆ Bankers say sterling starved of supply