Banks

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

◆ Third benchmark SP from the Landesbank becomes year's tightest ◆ This brought challenges and price discovery ◆ Higher new issue premium compensated with 'good' foreign buying

-

◆ Sole management enables quick sale ◆ Debate on fair value but some concession left ◆ Big green bond comes between two SNP redemptions

-

◆ Both issuers shake off different macro uncertainties ◆ Geopolitical spike no hindrance for RBI's AT1 refi ◆ Société Générale erases concession despite French political risk

-

-

◆ Deal attracts granular book for a Pfandbrief ◆ Premium paid but outcome still 'fair' ◆ Elsewhere, Finnish sub-benchmark deal proves popular

-

◆ 10 year non-call period is longest since 2014 ◆ Pricing comes very close to shorter Nationwide deal from June

-

◆ German issuer lands €1bn at tightest spread... ◆ ...but still pays a premium ◆ Shorter Pfandbriefe less popular with issuers this year

-

◆ Nordea outmanoeuvres spread widening by waiting to print in euros ◆ It and Crelan's SNP deals attract close to €6bn of orders ◆ 'Right to pay' some concession

-

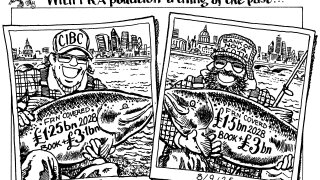

◆ Scotia moves quickly to tap resurgent sterling market ◆ Trade lands through CIBC and flat to fair value ◆ Confidence returns to sterling covered investor base

-

◆ Possible record demand for first non-UK benchmark since PRA debacle in April ◆ Deal lands flat to fair value and euros ◆ Market hopes more names will follow

-

Barclays is past halfway in its three year growth plan — it needs to accelerate