Taiwan’s life insurance companies are in a bind. One of their most favoured investment products, the long-dated US dollar callable private placement, is not delivering the returns it used to.

Yields on long-dated callable paper have been dropping for years, but are now falling exponentially. In the first quarter of 2016 yields of 4%-5% were possible, but were down by as much as 1% by the summer. Alongside the general low yield environment across global markets, swap rates, which issuers use to monetise call options on the bonds they sell, are also falling.

Taiwanese life insurance companies like privately placed long-dated callable bonds because they have typically offered a yield that meets their target. The paper had to be long dated, normally from 20 to 30 year tenors, to ensure the issuer can sell the call option at a rate that makes the deal worthwhile. Call options in this case range from one to five years.

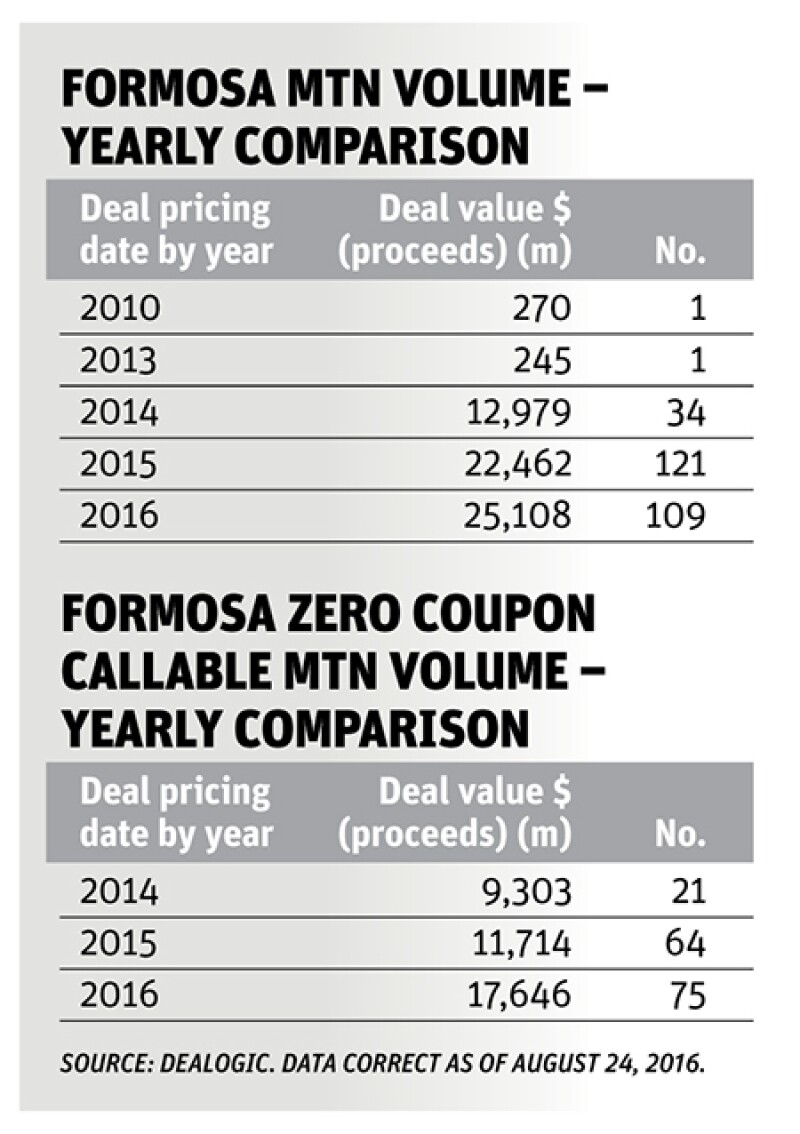

Foreign issued private placements also became more attractive when Taiwan opened up its Formosa market in 2014. Before the change, Formosa bonds bought by life insurers counted as foreign debt for which they had strict investment limits. But with the rule change, Formosa bonds could be listed in Taipei and be designated as domestic debt, allowing investors to buy in greater volume.

And as bankers covering the market point out, most international bonds listed in Taiwan are private placements. Listing the issue as private offers a fast-track process compared with public deals. An issuer just has to file an application with the regulator and if there are no questions it is automatically validated after three days.

By comparison, if a borrower opts for a public bond then there various procedures, such as getting approvals from the regulator and central bank, which are time consuming. And most bond pricing is time sensitive, so issuers go for private placements.

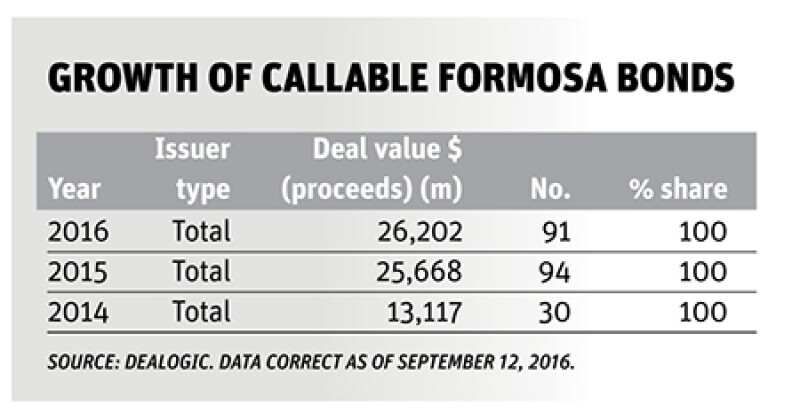

This is backed up by the figures which show that in the year to June 2016, borrowers had issued $81bn of Formosa bonds of which 80% were private placements. And those private placements are primarily long-dated fixed rate callable bonds or callable zeros, which offer internal rates of returns equivalent to the yield on a fixed rate deal. Of the $81bn worth of Formosas, $38.7bn are callable zero bonds, according to Dealogic data.

Whether fixed rate or zero coupon, the call options have been the key to the products success and are also the source of some of the recent challenges for investors.

“They are callable for a simple reason, it gives the issuer tenor flexibility,” said Stephen Chan, senior executive vice president, head of corporate finance and deputy head of institutional banking at Fubon Bank. “Most are very long, up to 20-30 years, so issuers want flexibility to call the bond if for example interest rates move not in their favour.

“Most deals at the moment are callable from one year annually because the external environment is very choppy, so issuers want maximum timing flexibility.”

In theory issuers have to pay for the shorter call with a higher coupon or yield, because they are able to redeem the bond sooner and investors have only locked in their desired rate of return for a shorter period of time. But there is too much liquidity in the Formosa market at the moment. As a result, the spread between a one year and five year call is only around 3bp.

To add further pressure this year, because issuers are favouring one year call options, many of the bonds life insurers hold could be called by the end of the year, said Chan.

“That will create pressure for them to replenish their portfolios and so they could be pushed toward lower yields if they have to buy or toward lower rated issuers in an effort to find higher yields.”

Issuer shift

In addition, times have changed from when life insurers were able to find the yields they were after from the highest rated issuers in the world. Triple-A rated supranationals and government agencies, such as World Bank and German development bank KfW, had been the issuers of choice in the years leading up to 2008 and the global financial crisis.

But as yields fell, Taiwan’s life insurers moved on to double-A rated names, where banks and corporates fit the bill.

“There is a real problem to meet margins, which has gotten worse over the past two years,” said a senior MTNs specialist. “In a lower rate environment triple-A issuers cannot deliver the yield that life insurance investors want.”

And as yields have continued to slide investors have moved on to single-A borrowers which are primarily banks and other financial institutions. And that homogeneity is an issue. At least three quarters of long-dated callable bonds sold into Taiwan are from banks and other financial institutions.

“The problem is they still put more weight on financial institutions than other issuers, because they know them,” said Kevin Pu at Yuanta Securities. “And they are offering increasingly lower yields.”

Private banks and financial institutions have printed 81.3% of long-dated callable Formosas in the year to August 31. That’s compares to 68.4% last year and 83.5% in 2014, according to Dealogic data. And much of the time, financial names print and self-deal these products, say bankers. For example, HSBC self-led a $2bn 4% 20 year callable bond in mid-August, 2016 — the largest ever Formosa.

But although there is general agreement that banks dominate issuance, the pool of issuers is on track to become more diversified.

“So financial institutions are still behind a major portion of issuance. But going forward I think there will be more and more foreign corporates trying to tap the Taiwan market,” said Fubon’s Chan.

“When any market tries to open up it is easiest for the top rated financial institutional issuers to tap the market first, when the market becomes bigger and more stable it will attract the attention of other non-FIs and investors will become more comfortable to try and diversify their investments. So corporates will play a bigger role in this market, it is a natural development.”

Companies that have already begun issuing in the Formosa market include US chipmaker Intel Corp and global brewer Anheuser-Busch InBev. Intel printed $915m of 4.7% 30 year paper in December 2015, callable after three years, while AB InBev issued a $1.47bn 30 year, with a 4.915% coupon and a non-call five structure at the start of this year.

Risky business

Meanwhile, taking on more risk is an option being considered. The single-A rating is typically where Taiwanese investors draw the line. Most of the life insurers have internal requirements for a minimum rating on an issuer. Government requirements are more liberal, but insurers tend to stick to their internal minimums, say bankers working in the market.

However, breaking that floor may become necessary, predict bankers. And Taiwan’s investors will have to decide whether they take more risk or continue to compromise on yield.

“The investors need to invest, so they are taking the lower yield because they are constrained by the lack of supply. They have to compromise in order to just invest,” said a senior MTNs specialist. “If they can take more risk then they might say I will take a lower rating, but it has to be at 3.7%, for example.”

But the Taiwanese are also looking for other ways to bump up yields.

“Available yields continue to drop, so the Taiwanese investors are opening up to geographic diversification and looking further afield to meet their targets,” said Standard Chartered’s global head of medium term notes, Annemarie Ganatra. “Traditionally investments have been focused on North America, Europe and to a lesser extent Asia.

“Now investors are also starting to look towards the Middle East and Latin America.”

The move began recently, noted Pu: “The life insurance companies are also shifting their interest to more diverse markets, such as southeast Asia and the Middle East. They having been doing this more since the second quarter this year.”

Lastly, the other development expected to diversify the market is an opening up to new tenors. Markets need different tenors to diversify otherwise, for example, most Formosa issuance will be long dated, giving no chance for a yield curve.

Corporates will join the market but they won’t need such long dated money, which will make the market more receptive to different tenors. Even if it is a single-A rated corporate for example looking for 10 year paper, both callable and straight bullet bonds, could offer the right yield and so become acceptable.