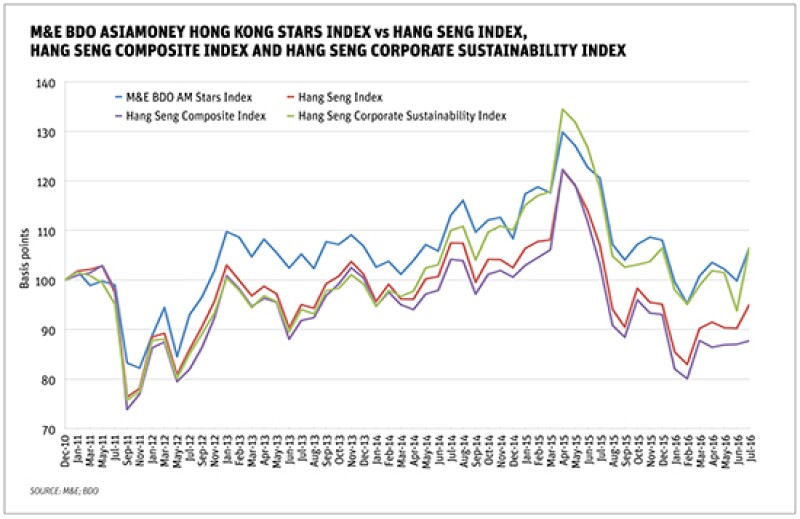

Starting in 2016, companies listed on the Hong Kong Stock Exchange (HKEX) have had to comply with tougher standards on reporting their environmental, social and governance (ESG) compliance. And there will be more standards to come in 2017. But do these regulations mean more costs for companies, or can they be sources of added profits?

A report from January by Deutsche Asset Management, which analysed 2,250 studies on the connection between ESG and corporate financial performance (CFP) since 1970, found that 62.6% of the studies showed a positive a correlation between ESG and CFP. Only 10% indicated a negation connection. For developed Asia 33.3% showed a positive correlation while 14.3% were negative.

The difficulty of such studies is that they only consider very general data, such as whether a company encourages investor activism or not. And the corporate financial data are equally general, using information such as net income, Ebitda or stock price. They do not demonstrate whether better financials were actually caused by ESG projects. It could very well be that companies with high ESG compliance are better run and therefore their better performances derive from more efficient operations management, marketing or corporate strategy, among others.

Hidden ROIs

To make a real case for ESG=Profits, we need to know the ROI (return on investment) of individual ESG projects. These could range from the value of energy saved by installing a new machine to added investor money attracted by installing independent board members. ESG is no different from the profitability of a production line in a factory. You need to figure out the ROI of each project and add them up to arrive at a total ROI figure for ESG.

To calculate an ESG project’s ROI, detailed data about costs and potential financial returns is needed. For example, CLP spent HK$14.5m ($1.9m) on community projects in 2015 (0.03% of its operating costs) which it claims impacted 178,000 people, according its 2015 sustainability report – equaling HK$ 81.5 per 'impacted person’.

Community (social) projects are key to CLP's financial success. When the company plans new plants or electrical facilities, communities can potentially halt or delay their construction in and out of court. Or, communities can oppose electricity rate hikes. Such measures can cost hundreds of millions. For example, CLP Power was forced to drop plans to build an HK$8bn LNG plant eight years ago due to opposition from environmental groups. Now it is reviving the plan again. The plant promises to reduce the cost of generating electrical energy and is now being reconsidered.

ESG project P&Ls

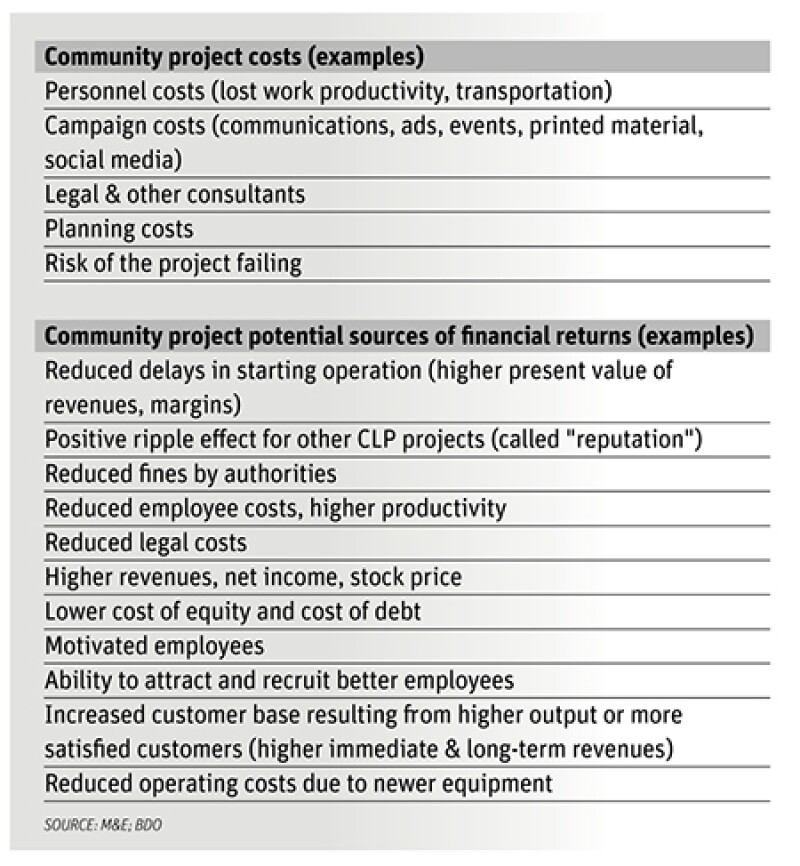

A typical ROI calculation for social programmes such as CLP's starts by considering direct and indirect costs as well as sources of potential financial returns:

While calculating these returns is complicated, it is evident that the financial ROI of such community projects for a power company can run in the thousands of per cent per year. In addition, the projects can reduce the cost of capital of the entire company and so raise its enterprise value significantly.

Yet the exact project ROI varies enormously according to the hundreds of variables which enter into calculating the ‘Social ROI’ of a project. For example, a major insurance company was faced with the decision whether to allow its call centre employees to work from home, in an effort to reduce productivity losses from employees frustrated by long commutes. In addition, the company could close its call centre, saving operating expenses. A ROI analysis showed that there was not a simple answer, but that some employees were more productive if they worked from home (type A) while others functioned better in the call centre (type B). The insurance company screened employees according to type A and type B, allowing type As to work from home. The ROI of this measure totalled several thousand per cent in the first six months.

The data needed to calculate ESG project ROI's are not published in annual and sustainability reports of companies or rating agencies. They can only be mined internally through audits, stakeholder survey and subject to a detailed ROI calculation methodology.

Even general ESG data are difficult to come by in Asian companies. Although CLP is considered a sustainable leader with a total score in the Dow Jones Sustainability Index of 57 points (the industry average is 52), one of the only ESG costs it published for 2015 is that HK$14.5m figure on community projects. CLP does reveal that its 17 energy saving projects economised 15.26GWh in Hong Kong. Investors who might wonder whether ESG is profitable for CLP, are left to calculate the value of a gigawatt hour and guess about the costs of the 17 energy saving projects mentioned. Its competitor, Power Assets, does not appear to publish hardly any data on what it spends for specific ESG areas, according to its 2015 annual report.

HSBC, a bank operating worldwide and used to complying with US and Europe transparency standards, is more detailed about its ESG costs. It says that it donated $205m to communities worldwide in 2015, splitting it according to region and basic purpose.

For service companies, such as a bank, community donations are about using social themes to gain and retain customers as well as to reduce risk of consumer complaints and legal cases. In effect, it is an interactive promotion campaign, and as such, fairly inexpensive. If done properly, it can create goodwill among customers and authorities. In 2015 the bank allocated $1.649bn for legal settlements and related provisions. HSBC spent $2.7bn on compliance (governance) related projects, up 33% from 2014, according to its 2015 annual report.

Vivian Chow is senior manager in the Risk Advisory Services at BDO Financial Services, Ltd. Hong Kong and William Cox is CEO of Management & Excellence (M&E). M&E and BDO in HK offer ROS® which is a proprietary method for calculating and raising the ROI of ESG. It's been used by major corporations on over 100 projects valued at $5bn since 2007.