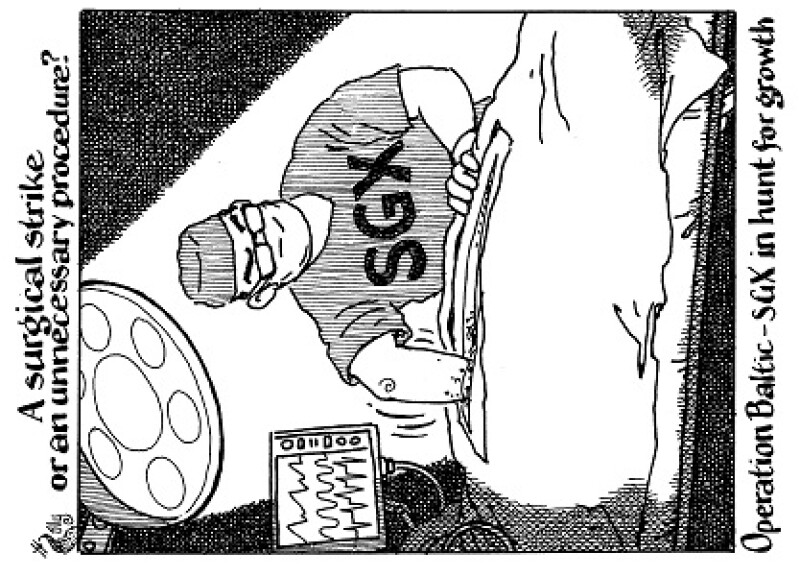

SGX said last week that it had entered into exclusive talks to buy 100% of the Baltic Exchange, fending off suitors for the 250-year old bourse. The London-headquartered exchange is known as a hub for trading of shipping contracts and owns the Baltic Dry Index, long considered the industry proxy for the global commodities trade.

On the face of it, SGX’s move makes sense. It fits into Singapore's ambition to be a global maritime hub, and will help the bourse build more of a presence in an industry where it already has decent traction.

Yet market participants have their reservations, and justifiably so.

For several years now the SGX has come under pressure to roll out big bang moves, but many feel its recent efforts, a lot of which have focused on wooing listings from overseas companies, have been less than triumphant.

This is mainly because the appeal of a Singapore IPO to a non-Singaporean company has waned as issuers increasingly look to list on their own domestic exchanges.

SGX has not stood still in the face of this trend. It has signed collaborations with banks, most recently with China Construction Bank, to build on a direct listings framework to attract mainland IPOs to Singapore. In the same vein, it also posted a key executive to China last year to drum up support from Chinese companies.

Given the numbers in Singapore, the push, including the latest to woo Baltic Exchange, is understandable.

For April the SGX reported a 23% month-on-month and a 21% year-on-year fall in total securities market turnover to S$21bn ($15bn). Daily securities average value fell 21% year-on-year, while for its fiscal third quarter, listing revenue was down 6%.

That came as year-to-date equity capital market volumes declined to $739m via 16 deals from $1.29bn via 21 deals in the same period last year, according to Dealogic. Meanwhile, cross-border listings on the exchange have gone from as high as $5.88bn in 2011 to a low of $183m last year.

But there are bright spots. The junior Catalist board has been a clear winner, with Catalist listings bringing in $159m last year and nearly half of the total IPO haul for 2015. Bankers say they have a healthy pipeline of Catalist IPOs that are being lined up despite the volatility.

The idea of more junior listings may not be music to the ears of those looking for a big move from SGX, but junior market flow can be an anchor in turbulent times.

Other areas that can also play to Singapore’s strengths are start-up and technology listings. The SGX formed a partnership with a venture capital firm to develop an early-stage equity capital raising platform that caters to companies in the pre-IPO stage. By putting such firms in the front of the queue for listings, the SGX can blaze a trail for the sector in Asia, which is not traditionally known as a hub for technology IPOs.

The bourse should also work with market participants in private wealth to build on its status as a hub for the region’s wealthy. Real estate investment trusts and the recent spree of Singapore dollar subordinated debt, for instance, enjoy a strong run because of private bank demand, and this is something the country can build on.

SGX has long looked far afield for growth. This is admirable, but in an environment where everyone is struggling to find returns, for SGX the proverbial pot of gold may be in its own backyard.