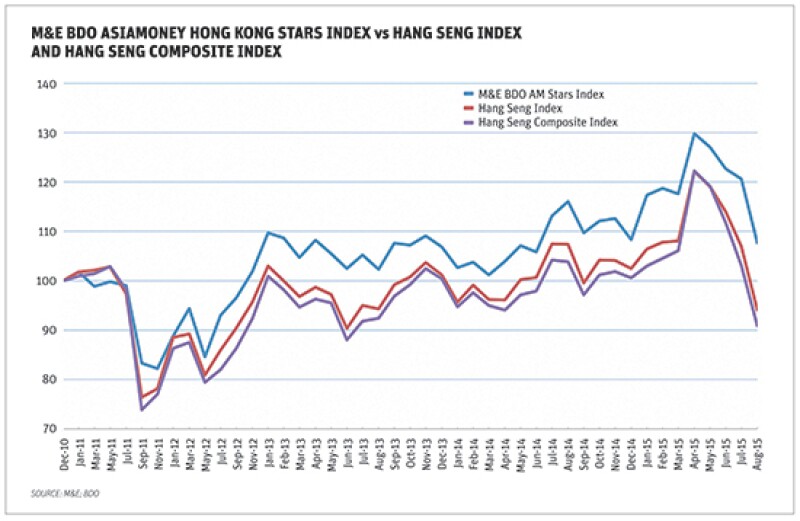

The Hong Kong Stars Index, an index of Hong Kong and China's 19 best governed stocks, outperformed the Hang Seng Composite Index in July and August 2015 by 17.5% and 16.8%, respectively — the highest levels of outperformance to date.

Investors who bought the Hang Seng in December 2010 are now 9% in the red, but those who put their money on the HK Stars Index are still 8% up. Coincidence? Or is governance an effective cushion in bear markets?

The HK Stars Index started life in December 2010. In June 2013, when the market dipped, it achieved its highest outperformance to date over the HSC of 14.3%. In the interim, its outperformance slipped to single digits. In September 2014, when the HSC and HSI dropped again, it slipped less, maintaining a 12.5% lead (see chart).

The HK Stars Index is unique in that it not only picks the stocks according to their governance and financial performance scores, but then goes on to quantify this performance and weights its 19 stocks from 13 sectors according to their exact levels of governance performance. As a result, better managed companies are relatively highly weighted.

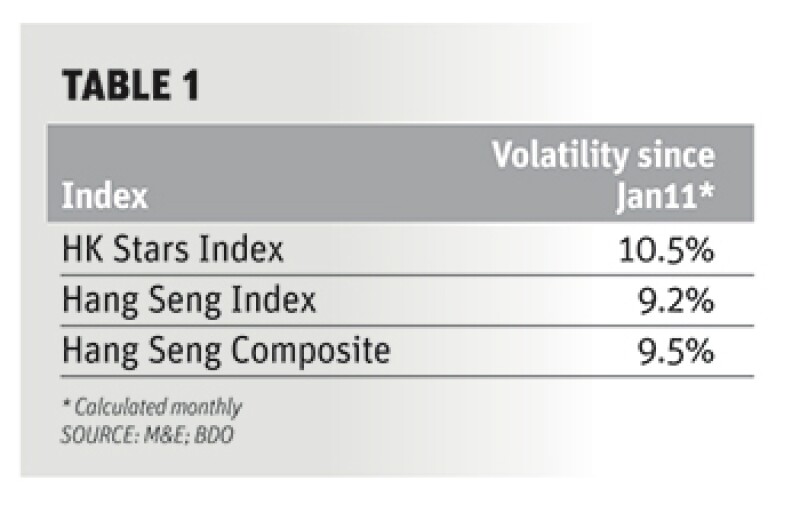

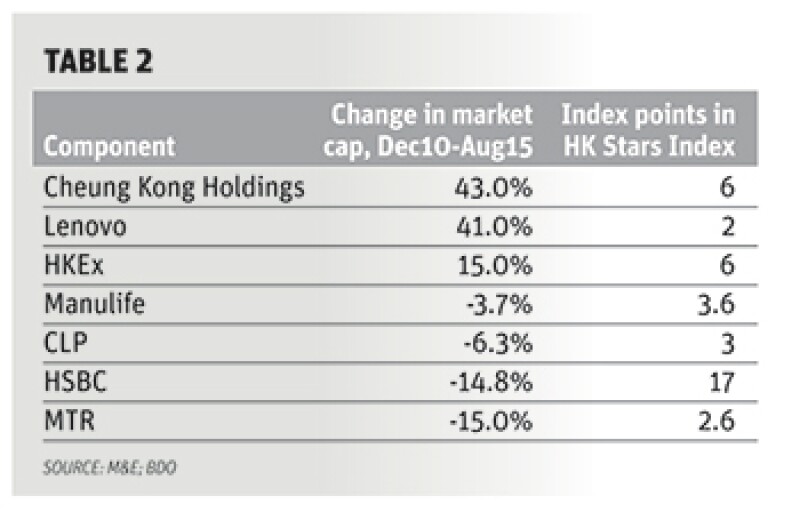

Yet, good performance has not translated into lower volatility. Indeed, the HK Stars Index has even been slightly more volatile than the HSC and HIS (see Table 1). And a closer look shows that several of the heavyweights in the HK Stars Index absorbed some of the current market decline (see Table 2). By contrast, one of the wIndex's worst performers was Shangri-la Hotels, which saw a decline of 57.3% but only contributes 0.2 points to the Index.

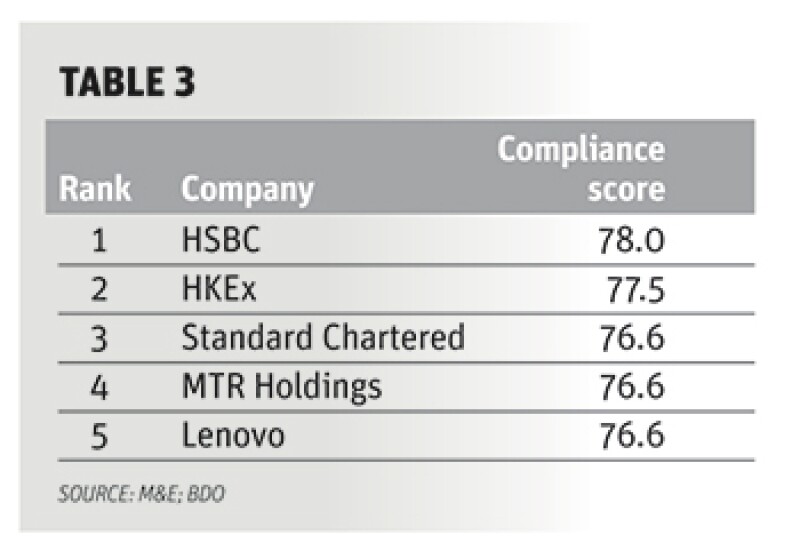

Four of the top five companies with the highest compliance scores are in the top performers list (see Table 3). Compliance is one of three areas comprising the total M&E BDO score. The Compliance Score measures each company's compliance according to more than 200 best practice areas.

Hong Kong Exchanges and Clearing (HKEx), is a good example for governance that seems to work effectively. The company implements a dense routine of interconnected governance control committees and processes, including internal and external audits, two risk committees, an audit committee, management committee, various board committees and three consultative panels, among other common institutions such as Board Committees. It also publishes no fewer than eight governance related reports for investors and the public.

HKEx also details the annual awards it has received since 2008, such as the Caring Company Award given by the Hong Kong Council of Social Service. In addition, the company puts out an annual Corporate Social Responsibility report that defines its employee and environmental policies and how these support its corporate strategy.

However, experience has shown that adhering to mere governance checklists, such as in the case of HSBC in the past, is hardly enough to produce good governance. It is important to look at evidence of an integration of governance checks and balances, which generates a strong internal performance culture. Poorly implemented governance processes can be expensive and impeding to performance.

Volatility and risk

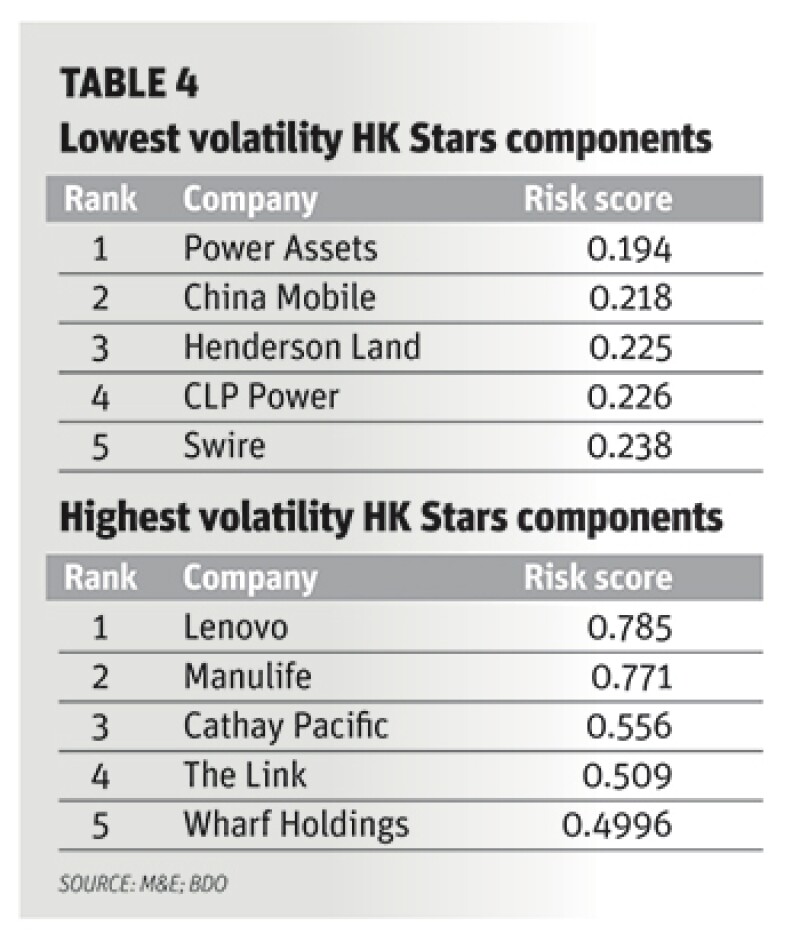

Another area in the HK Stars Index calculation is the volatility of key financial results over the past three years (calculated on an annual basis), which is called a company's Risk Score (see Table 4). Here, low volatility does not correlate with long term outperformance. But this may indicate strongly improving financial performance as well, as in the case of Lenovo.

Companies with stable revenue streams, such as Power Assets, CLP Power and Henderson Land, with gradual but consistent growth, typically yield low Risk Scores. High Risk Scores tend to reflect high revenue shifts and changes in debt levels, such as in the cases of Hong Kong and China companies. China Mobile's drop of 19.4% since December 2010 is still relatively moderate, however. With 33 Index Points, it weighs in as the heaviest component in the HK Stars Index.

William Cox is CEO of Management & Excellence, Madrid and New York, which is partnered with BDO Financial in Hong Kong and Asia. He received his PhD from the London School of Economics and graduate degree in finance from Oxford.