Kenya looks to have averted default this week with a new issue raised to partly refinance its $2bn 6.875% bond maturing in June, allowing it to pay investors. It is good news that the country will avoid default but the episode demands examination and introspection about the choices it made that landed it in such a situation in the first place.

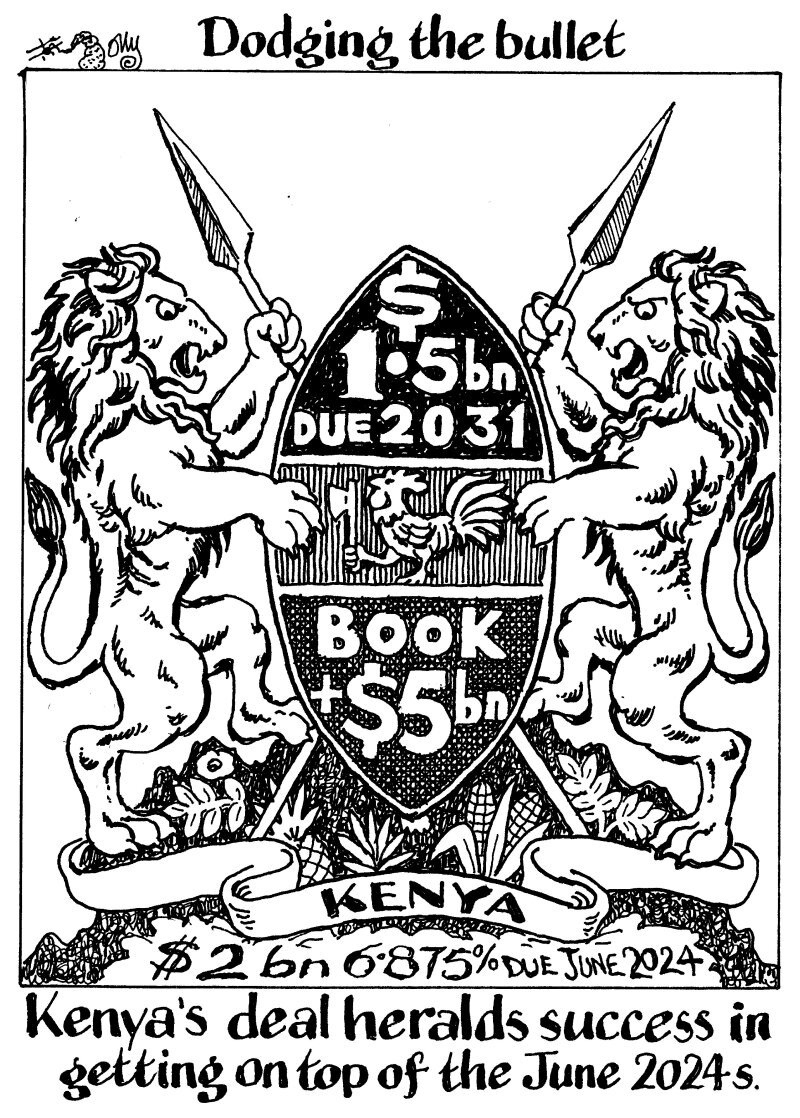

Proceeds from the $1.5bn 9.75% 2031 amortising bond Kenya sold on Monday will be used to buy back up to $1.5bn of the 2024s — which investors not long ago viewed as at risk of default. The deal slashes its immediate repayment risk, albeit the new bond was priced at a discount, meaning Kenya paid a yield of 10.375% for the new deal, not including any fees or other costs.

The new bond was popular. Order books closed at over $5bn, implying many investors were comfortable with the credit and so all's well that ends well — but it very nearly wasn't.

Questions swirled for a year right up to when Kenya mandated its new trade about whether it could refinance in the bond market, or whether it had enough foreign currency reserves to repay investors.

Kenya got its deal done thanks to a recent uplift in sentiment in emerging market bonds, linked mostly to prevailing views on dollar interest rates, which the country has no control over.

For all this week's relief, the question must be asked as to why Kenya did nothing to mitigate the repayment risk of that $2bn deal earlier in its 10 year life. Until now, Kenya has attempted no liability management.

Contrast Kenya with Gabon, for example, which has a $1.5bn 6.375% note due in December. It has reduced it to $500m through liability management. Ivory Coast, which issued in January, has a $750m 5.375% bond due in July but only $141m is left to repay.

Kenya rolled the dice and won this week — its lower coupon debt will remain outstanding for as long as possible.

But it could just have easily have rolled and lost, risking a developing country with need of external financing becoming a bond market pariah.