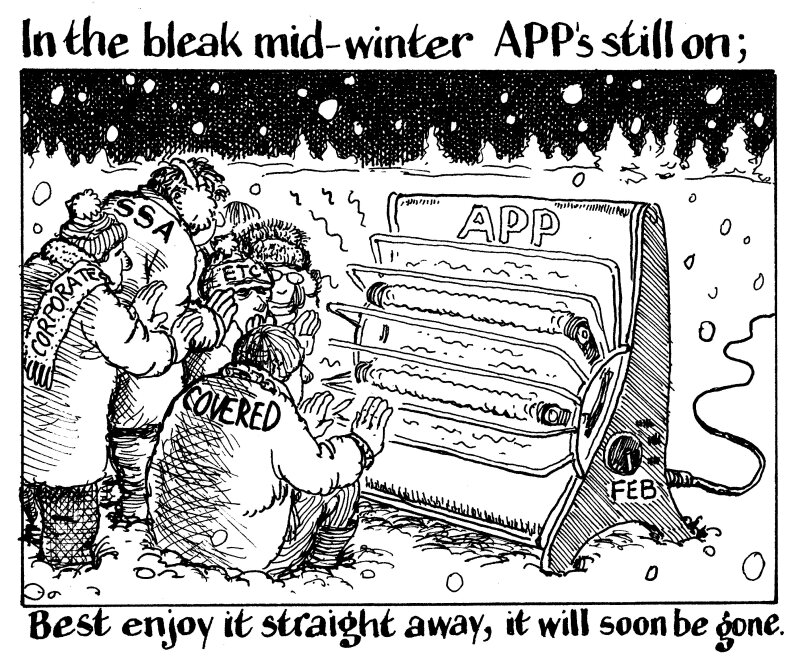

January is typically the busiest month of the year in the primary bond market as issuers take advantage of fresh cash being put to work by investors, who are also charged with redeploying an avalanche of redemptions, which are often at their highest.

But this year there is a much greater funding cliff edge to contend with as borrowers must grapple with the retreating central bank bid.

In December the European Central Bank announced it would begin curtailing purchases under its Asset Purchase Programme, by cutting reinvestments from this portfolio by half, or €15bn, from March.

With rates set to rise at least two more times, the ECB will have its work cut out trying to tame inflation.

Accordingly, there is a high likelihood it will opt to cease reinvesting deals maturing from its APP portfolio altogether from June.

This means the sovereigns, supranational and agency borrowers as well as covered, corporate and ABS issuers will need to find real investors.

Unlike the ECB, these new buyers will take a long hard look at the associated credit risks before placing an order, auguring poorly for spreads.

As bad as that seems, it is business as usual in January and February. Covered bonds, for example, will continue to benefit from the ECB’s primary market order worth 20% of a deal’s size.

Overall, the ECB is expected to fully replace €11bn of covered bonds that mature in the first two months of the year, meaning it will be actively supporting the secondary market too.

As the usual flurry of deals at the beginning of January begins to moderate, there should be good funding windows at selective points over the next seven weeks, but possibly not thereafter.

The ECB’s order is not everything, of course. A 50bp rise in yields since early December has helped, alongside a stoic approach from investors to credit, which is bound to deteriorate as recession starts to bite.

For these reasons, it makes absolute sense, this year more than any other, to get the largest and most challenging deals completed with haste.