In the good old days in the EM bond market (i.e. large swathes of the last decade until around September last year) investors had a recurring complaint. Markets frequently heated up enough for issuers to price bonds through their curves at will with single-B rated debut borrowers with local currency revenues able to clinch absurdly low financing costs.

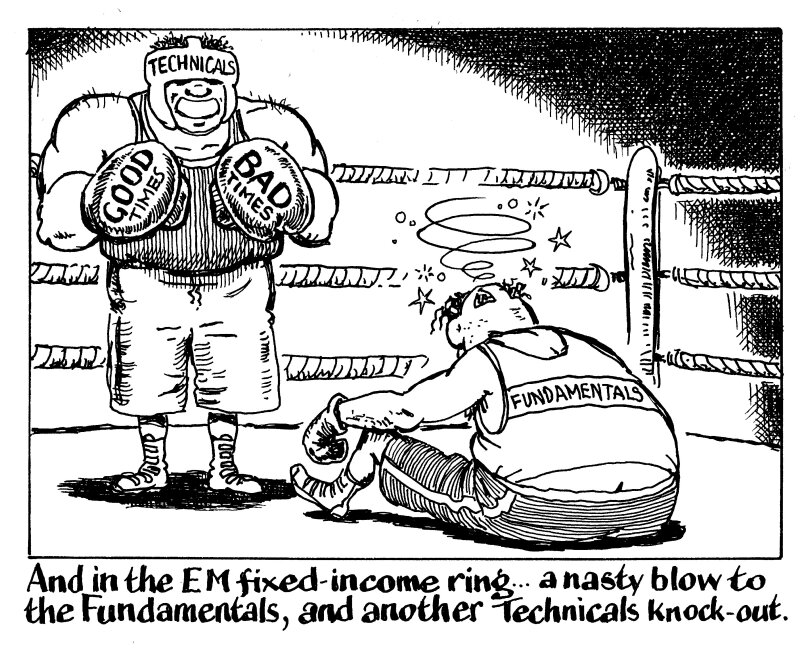

The verdict was predictable with investors complaining that fundamentals had been thrown out the window every time a deal was priced with no new issue premium only to rip tighter on the break.

Fast-forward to 2022, and the dynamics have reversed. Suddenly, there is a consensus that there is value all over emerging market fixed income. But if there are so many bargains out there, why aren’t buyers buying and prices rising?

LatAm oil companies that have been throwing off cash, yet whose bonds have failed to catch a bid, is one such head-scratcher. Other EM bonds have crashed on negative news, only to fail to bounce when a remedy appears.

Some credit analysts have given up recommending trades to investors, one of their main jobs, with one admitting in a note to clients that she “does not feel comfortable calling the lows” on a LatAm sovereign even if she’d previously considered a higher price as a good entry point.

One portfolio manager gave an eerie sense of déjà-vu. “Fundamentals just don’t matter,” he said. “Don’t talk to me about double-Bs offering 8% because nobody cares. I just want cash.”

Even now, technicals outweigh the fundamentals, making EM bond investing something of a minefield. Only this time, it’s all rather more grave than the mild frustration when a bond has come 12.5bp tighter than you had hoped.

Emerging market investors are bruised, battered, and need cash to protect themselves against brutal outflows. Buying risky and often illiquid assets in the face of endless bad news is simply not feasible if you are in a fight for survival — no matter how enticing an Ecuador bond offered at 40 might look given default risk is negligible.

Alas, it’s the cruel irony of emerging markets investing, an industry in which fund managers love to talk up their special “selective” approach to investing and unique “bottom-up” credit research, but that is subject to more extreme technical dislocations than any other asset class.