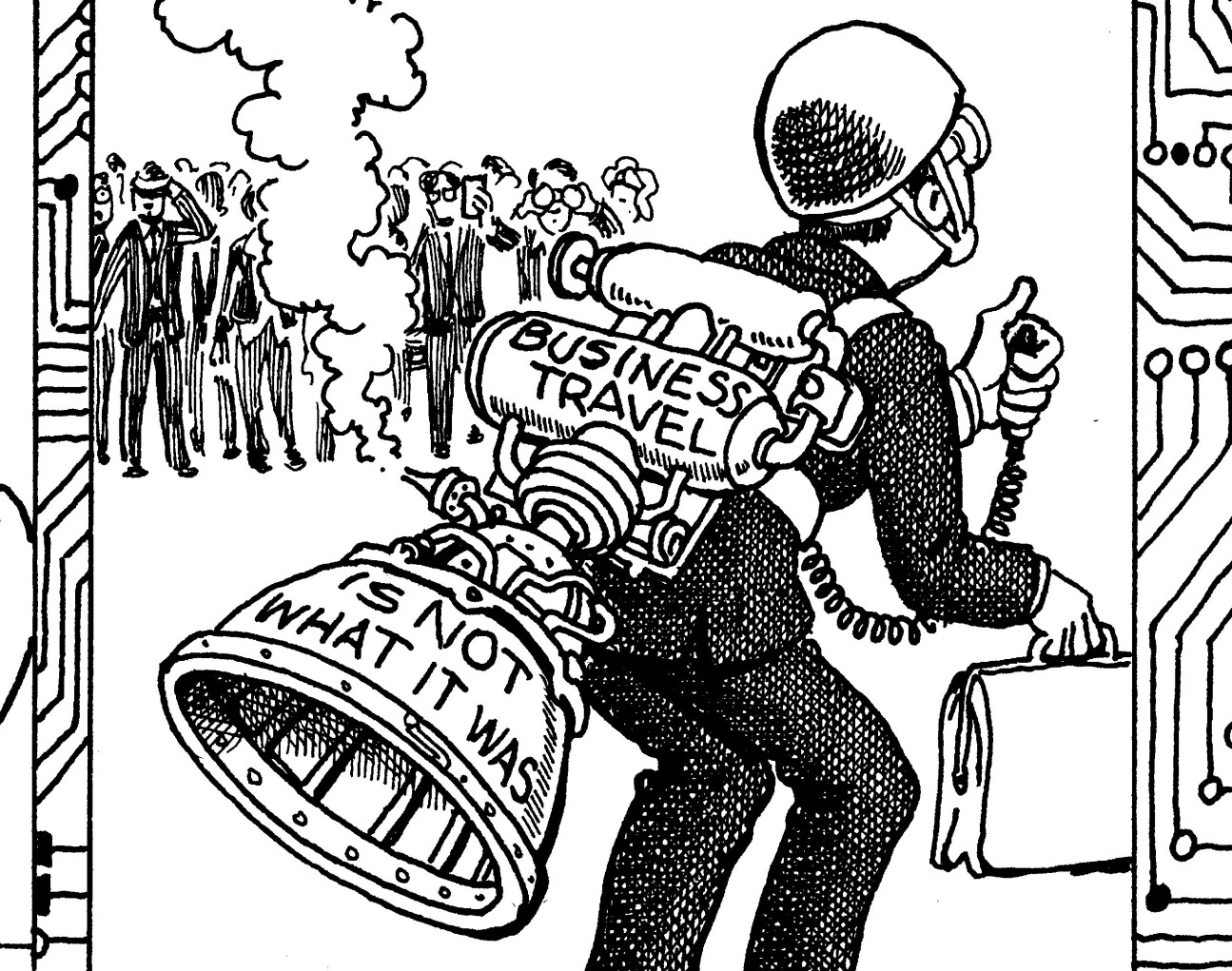

Overview — Covid and the capital markets: Why business travel will not return to pre-pandemic levels

International business travel is not expected to return to the capital markets on the same scale as before the pandemic, for more reasons than one

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts